Zerodha Review

Overview

Zerodha is India’s No. 1 stockbroker and it offers flat-fee discount brokerage services that allow you to invest in Equity, Commodity, Currency, IPO or Direct Mutual Funds.

Zerodha offers a cost-effective, no brokerage charge for equity delivery trades and direct mutual funds. Intraday and F&O trades have a flat fee of Rs 20 or 0.03% (whichever is lower), which will always be the lowest possible cost per trade you pay with Zerodha. The maximum amount you can be charged for any transaction is only Rs 20.

About | |

Company Type | Public |

Headquarters | Bengaluru |

Broker Type | Discount Broker |

Founder | Nithin Kamath, Nikhil Kamath, Dr Kailash Nadh |

Established Year | 2010 |

The best stock broker in India is Zerodha, having officially served its audience since 2010. Achieving the rank of being number one among other top brokers, Zerodha has made a name for itself and is recognized as well.

Kamath founded the company, which was originally a stock trading firm before he expanded it into an online broking house.

Zerodha was founded with the goal of breaking down barriers that Indian traders, investors, and other aspiring money makers face in today’s economic climate.

Zerodha Account Opening Charges

A Zerodha online account opening will cost ₹ 200, while an offline account will be charged ₹ 400. For both accounts, the Zerodha Demat account opening annual maintenance charge is ₹300 per year.

Account Opening Fees | |

Trading AMC (Yearly) | ₹ 0 (Free) |

Trading Account Charges (One time) | ₹ 200 |

Demat AMC (Yearly) | ₹ 300 |

Demat Charges (One time) | ₹ 0 |

Margin money | 75% margin |

Zerodha has been widely successful due to its open-minded approach, which allows people throughout the country to become a member of the brokerage house and trade under Zerodha’s banner with no prejudices or partiality.

Anyone from any corner of the country can become a registered trader with them anytime by simply depositing Rs.300 through CSDL in Zerodha new account opening charges.

Zerodha Brokerage Accounts Charges & Fees

Zerodha has a fixed brokerage model that charges Rs 20 or 0.03% (whichever is lower) per executed order, and it also offers zero broker fee on equity delivery. The maximum amount of brokerage you can pay for an order is Rs 20.

Brokerage charges & fees | Zerodha |

Equity Delivery | ₹ 0 (Free) |

Equity intraday | Flat ₹20 or 0.03% whichever is lower per executed order. |

Equity options | Flat at ₹ 20 per executed order on turnover |

Equity futures | Flat at ₹ 20 or 0.03% whichever is lower per executed order. |

Currency options | Flat at ₹ 20 or 0.03% whichever is lower per executed order. |

Currency futures | Flat at ₹ 20 or 0.03% whichever is lower per executed order. |

Minimum brokerage | Zero |

Commodity | Flat at ₹ 20 or 0.03% whichever is lower per executed order. |

Margin money | 75% margin |

Demat AMC Charges | ₹ 300 per annum |

Trading AMC charges | Free |

The brokerage structure for Zerodha is listed below.

Equity Delivery Based trades are based on Zerodha broker charges. This has been a rule set out by Zerodha since December 2015.

Equity Intraday trades will be charged at 0.03% or Rs. 20/order executed whichever is less, while rates for equity options are the same except that brokerage charges will depend on turnover, too.

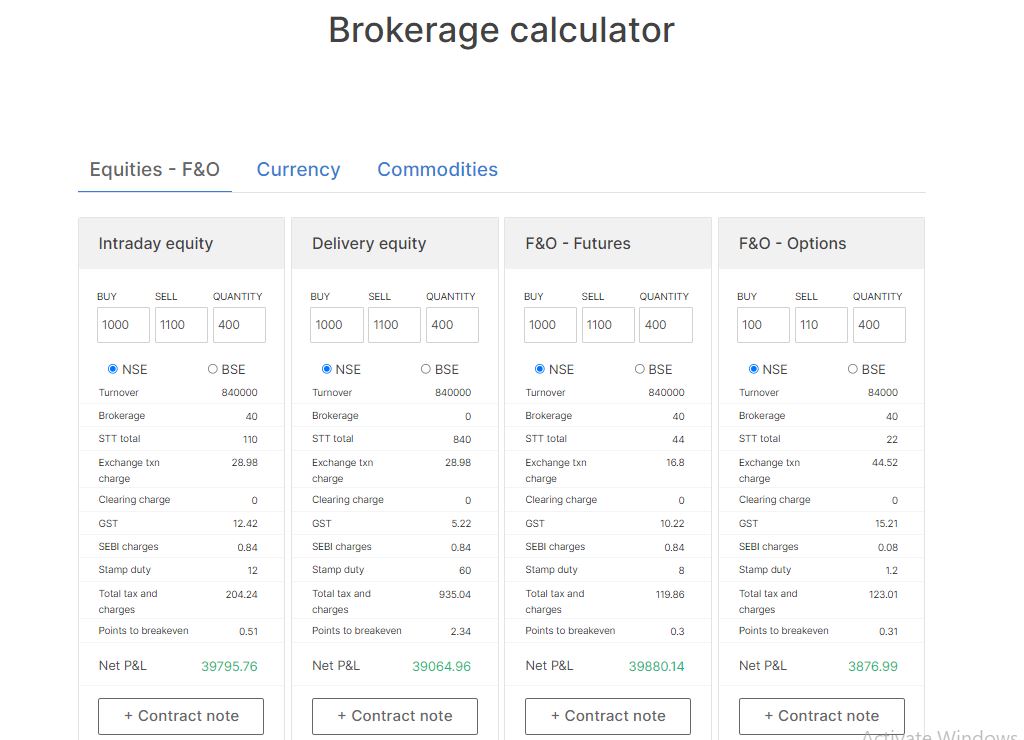

Zerodha will charge a brokerage of Rs. 20 per trade, but it also offers an online live Brokerage calculator that will allow investors to compute the rates applicable to their investments and transactions.

Zerodha Equity Charges

Zerodha’s brokerage is zero for equity delivery trades, and flat Rs. 20 per executed order in intraday trading or 0.03% on both sides (whichever is lower).

Charges Type | Equity Delivery | Equity Intraday |

Brokerage | ₹ 0 (No Brokerage) | Flat ₹ 20 or 0.03% (whichever is lower) |

Securities transaction tax (STT) | 0.1% on both buy & sell | 0.025% on the sell-side |

Transaction/TurnoverCharges | NSE: 0.00325% | BSE: 0.003% per trade (Each side) | NSE: 0.00325% | BSE: 0.003% per trade (Each side) |

Goods & Services Tax (GST) | 18% of the brokerage and transaction charges. | 18% of the brokerage and transaction charges. |

SEBI Charges | 0.0001% (₹10/crore) | 0.0001% (₹10/crore) |

Stamp Charges | 0.015% (₹1500 per crore) on the buy-side | 0.003% (₹300 per crore) on the buy-side |

Zerodha F&O Charges

Zerodha F&O brokerage charge is Rs 20 flat per order or 0.03% (whichever is lower). You also have to pay taxes like STT, Transaction Fee, GST and SEBI charges as well as Stamp Duty.

Charges Type | Equity Delivery | Equity Intraday |

Brokerage | Flat ₹20 or 0.03% (whichever is lower) | Flat ₹20 or 0.03% (whichever is lower) |

Securities transaction tax (STT) | 0.01% on the sell-side | 0.05% on the sell-side (on premium) |

Transaction/TurnoverCharges | NSE: 0.0019% | BSE: 0.003%(Each side) | NSE: 0.05% | BSE: 0.003%(Each side) |

Goods & Services Tax (GST) | 18% of the brokerage and transaction charges. | 18% of the brokerage and transaction charges. |

SEBI Charges | 0.0001% (₹10/crore) | 0.0001% (₹10/crore) |

Stamp Charges | 0.02% (₹200 per crore) on the buy-side | 0.003% (₹300 per crore) on the buy-side |

Zerodha Currency Charges

Zerodha currency charges a flat fee of Rs 20 per executed order, or 0.03% of the trade value (whichever is lower). In addition to brokerage, Zerodha will charge taxes like STT and GST on transactions.

Charges Type | Currency Delivery | Currency Intraday |

Brokerage | Flat ₹20 or 0.03% (whichever is lower) | Flat ₹20 or 0.03% (whichever is lower) |

Securities transaction tax (STT) | No STT | No STT |

Transaction/TurnoverCharges | NSE: 0.0009% | BSE: 0.00022% | NSE: 0.035% | BSE: 0.001% (On premium) |

Goods & Services Tax (GST) | 18% of the brokerage and transaction charges. | 18% of the brokerage and transaction charges. |

SEBI Charges | 0.0001% (₹10/crore) | 0.0001% (₹10/crore) |

Stamp Charges | 0.0001% (₹ 10 per crore) on the buy-side | 0.0001% (₹ 10 per crore) on the buy-side |

Zerodha Commodities Charges

Zerodha charges customers a flat fee of Rs 20 or 0.03% (whichever is lower) per executed order, in addition to the taxes and fees like STT, GST and SEBI Charges that are applicable on the client’s trade.

Charges Type | Commodity Delivery | Commodity Intraday |

Brokerage | Flat ₹20 or 0.03% (whichever is lower) | Flat ₹20 or 0.03% (whichever is lower) |

Securities transaction tax (STT) | 0.01% on the sell-side (Non-Agri) | 0.05% on the sell-side |

Transaction/TurnoverCharges | Group A: Exchange transactions have a charge of 0.0026%. Group B: Exchange transactions for Pepper cost 0.00005%, Castorseed costs 0.0005%, and Rbdpmolein transaction charges are at 1%. | ₹ 0 |

Goods & Services Tax (GST) | 18% of the brokerage and transaction charges. | 18% of the brokerage and transaction charges. |

SEBI Charges | 0.0001% (₹10/crore) | 0.0001% (₹10/crore) |

Stamp Charges | 0.002% (₹200 per crore) on the buy-side) | 0.003% (₹300 per crore) on the buy-side) |

Zerodha Margin Exposure Or Leverage

Exposure/Leverage | |

Equity Delivery | 20% of the trade value can fluctuate according to the stock’s volatility (VaR+ELM+Adhoc margins). |

Equity Futures | 1x (100% of NRML margin (Span + Exposure)) |

Equity Intraday | 1x (100% of NRML margin (Span + Exposure)) |

Equity Options | 1x (100% of NRML margin (Span + Exposure)) |

Commodities | 1x (100% of NRML margin (Span + Exposure)) |

Commodity options | 1x (100% of NRML margin (Span + Exposure)) |

Commodity futures | 1x (100% of NRML margin (Span + Exposure)) |

Now, suppose you paid attention to the above table of contents. In that case, you would be astounded by Zerodha’s range of financial instruments for their registered traders.

You can trade commodities, currency options and equity futures with them. You’ll also have the opportunity to trade equities intraday and earn up to 100% of NRML’s margins (SPAN + Exposure) on these trades. In total, they’re offering exposure as high as 1x on Equity Delivery Trading, Currency Options Trading or Commodities Trading respectively- which is a competitive offer in today’s market!

Other Charges

Other Charges | |

SEBI Turnover Charges | ₹ 10/crore |

STT | Equity Delivery: 0.1% on both buy and sell. The Equity Intraday Sell-Side has a rate of 0.025%. Equity Futures: 0.01% on the sell-side Equity Options: 0.05% on Sell-side (on premium) Commodity Futures: 0.01% on the sell-side (Non-Agri) Commodity Options: 0.05% on the sell-side There is no STT on Currency F&O. The cost for Exercise transactions is 0.125%. Right to entitlement: 0.05% on sell-side |

GST | 18% on (Brokerage, Transaction Charge, and SEBI Fee) |

Stamp Duty | (On buy-side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options:0 03, and Currency F&O (or Forward): .0001% Commodity Futures; .002%; Commodity Options (MCX); .003%. |

Reactivation Charges | ₹ 20 per institution |

Margin Funding Charges | 18% + GST |

Dematerialisation Charges | ₹ 30 per institution |

Pledge Invocation | ₹ 20 per ISIN |

Pledge Creation | ₹ 30 per request |

Account Closure Charges | ₹ 25 per institution |

Margin Repledge | ₹ 2 CDSL fee |

Margin pledge/Unpledged/Pledge Closure | ₹ 9 + ₹ 5 per request CDSL fee |

The STT is a charge that only applies to the sell-side in intraday and F&O transactions. It should also be charged on both sides for equity trades.

- They impose Stamp Duty charges for all the Indian states, which change at a fixed rate of 0.015% or Rs 1500/ crore on the buy-side with Delivery and 0.003% or Rs 300/ crore on buy-side intraday and options trading as well as futures trading of 0.002%.

- The transaction charge is very small and falls between NSE: 0.00345% BSE: 0.003% (on equity), NSE: 0.002% for Futures, and NSE: .053% (on premium) for Options

- The service tax charge for all transactions will stay at 14% of the total amount.

- The cost of the SEBI charge is ₹ 10/crore for every crore of the transaction.

- The call and trade feature of Zerodha will cost you ₹.50 per call and is only applicable for the 21 banks listed in “over”. The Instant Payment Getaway is applicable to all those who choose over 2 banks, at ₹ 9 per transfer.

- DP charges Rs.13.5 + GST per scrip for delivery-based equity selling.

- The pledge charges are Rs.30 + GST per request.

Zerodha Products & Services

The brokerage house offers a variety of technological add-ons, services, and products to help investors in stock and securities trading.

Zerodha Products

Products | |

Equity trading | Yes |

Currency trading | Yes |

Commodity trading | Yes |

Futures | Yes |

Options | Yes |

Forex | Yes |

Mutual funds | Yes |

Banking | No |

Forex | No |

Insurance | No |

SIP | Yes |

You will easily find out that Zerodha offers products related to futures trading, currency trading, equity trading, options trading and commodities.

You may have noticed that the reputable brokerage house does not offer any products related to Forex Trading, Insurance services, or Generalized Banking.

Zerodha lets you trade in many marketable securities, such as –

Futures and options are different derivatives, meaning they derive their value from an underlying asset. The main difference between the two is that futures contracts involve buying or selling a security at a pre-determined date and price, whereas, options allow both parties to buy or sell securities for a predetermined price.

An option is a contract that gives the investor the right to buy or sell a security at a specified time and date.

Commodity derivatives are those types of derivatives that create their value from the underlying commodity. Commodities include coal, copper, gold, cotton and wheat; spices may also be included in this list

Currency derivatives allow investors to invest in the currency of various countries.

Mutual Fund Units – Buy units of mutual funds directly from Zerodha and secure your savings with growing income.

Zerodha offers a variety of investment options, including stocks and mutual funds as well as bonds and securities.

Zerodha Services

Services | |

Demat Services | Yes |

3 in 1 account | No |

Trading Services | Yes |

IPO Services | Yes |

Intraday Services | Yes |

Robo Advisory | No |

Stock Recommendations | No |

Trading Exposure | Yes |

Trading Institution | Yes |

PMS | No |

Now, this is interesting. Suppose that you take a closer look at the table drawn up above.

If that is the case, you will be able to find out easily that Zerodha, as a discount brokerage company, provides all sorts of services in regards to initial public offerings, trading, intraday and Demat, with an exposure of up to twenty-eight times.

Nevertheless, you will also be aware that the brokerage house does not offer any support in managing your portfolio (by providing services like a 3-in-1 account, or stock recommendations).

Zerodha provides more to investors than just smart trading. Varsity is a resource for education and information on Indian capital markets.

Stocks & IPO – Zerodha is a platform that provides equity shares of companies already revolving in the stock market. It has made it all simpler than ever before.

Additionally, there is a 60-day challenge for interested investors through which they can get their brokerage back. There is also an online link where they can share their earnings with others as well.

Aside from these, there are also products that focus on market intelligence. Pulse will allow investors to stay up-to-date with the latest happenings in business and finance.

The Trading Holiday calendar will give you an idea of all the trading holidays, and there are also circulars and newsletters for clients.

Zerodha Trading Platform

Zerodha Kite Web

Kite is a powerful online trading platform built in-house by the company Zerodha. It offers a fast and reliable trading experience to traders, as it’s zerodha web-based.

- This universal search tool lets you look for stocks and F&O contracts across multiple exchanges instantly.

- Real-time data widgets can provide quotes, live ticks, and order alerts among other things.

- With over 100 different indicators, studies, and tools to use for advanced charting capabilities and extensive historical data.

- They have a multilingual platform that supports 11 regional languages.

- There are a variety of order types available, including Limit, Market, Stop-Loss orders and more.

- Zerodha offers a range of partner apps that offer integration, including smallcase and streak.

- It’s easy to transfer or withdraw funds with a single click.

Zerodha Kite Mobile (Mobile Trading App)

Zerodha Mobile is a trading app available on Android and iOS devices. It provides essential features, like the ability to analyze and trade all from your phone. You can download the Zerodha app to access Zerodha’s Kite Web platform on smartphones, allowing you to do everything that was previously possible only through an internet browser.

- Just one tap to search for stocks and contracts across all exchanges.

- Make multiple MarketWatch

- Live market watch

- Quick buy & sell

- Advanced charting features with over 100 indicators and studies.

- Live market depths

- Just one tap to search for stocks and contracts across all exchanges.

- The various order types include AMO, GTT (Good Till Triggered), and CO (Cover orders).

- Historical data.

- Fund transfer facility.

Zerodha Coin (Mutual Fund Investment)

Zerodha Coin is a new way to invest in mutual funds. You can do it online, with zero commissions. It also includes various features like direct investment from companies and no-commission investments

- The free platform for fund investments.

- Direct mutual fund credits will be credited to your Zerodha Demat account.

- Single reports like the capital gain statement, P&L visualizations, and so on for all your investments.

- Zero commission charged.

- With the SIP facility, you can increase or decrease the amount of it as per your requirement.

- View and track the account’s net value.

Zerodha Console (Back-Office)

Zerodha’s back office is called Console. It provides a trade and reporting dashboard with loads of features for Zerodha customers such as

- It is easy to place withdrawal requests.

- You can monitor credits and debits in your trading account by looking at your account statement.

- View your portfolio – stocks and mutual fund investments

- Download a contract and margin statement.

- You have access to multiple reports, such as the trade book and P&L.

- Use analytics tools such as Tradebook and P&L Heatmap to access the information.

Zerodha Sentinel (Price Alerts Tool)

Sentinel is a cloud-based, machine-independent tool that allows you to set up price alerts on stocks and contracts. You can create an alert triggered when prices reach a certain point or even just when your computer is off.

- Manage alerts for over 80,000 instruments across exchanges.

- With an advanced alert, you can combine multiple triggers.

- Get alerts on the Google Chrome browser, Kite web platform and through email.

- Access the history of all your triggered alerts.

- We offer 30 free trigger alerts based on a single data point.

- Non-clients of Zerodha can avail of this offer too.

- Supports a variety of data points, such as today’s Open, High, Low, Close Volume Percentage Change Open Interest Total Bids Total Asks etc.

- A single data point can only generate 30 trigger alerts.

Partner Products Offered By Zerodha

Zerodha Smallcase

Small cases are portfolios or collections of stocks and ETFs built around a single idea, strategy, or theme. A small case contains 2 to 50 instruments. With your Kite account and Zerodha account, you can follow the portfolio’s performance on their platform with one click.

Zerodha small case features

- 55+ different small cases to choose from.

- There are four smallcase types thematic, model-based, sector trackers and beta.

- Investors with all risk types including conservative, moderate, and aggressive can invest in small cases.

- Track and monitor your investments anytime, anywhere.

- There are no lock-in periods with these funds, unlike some mutual funds.

Zerodha Streak Algo Trading

Zerodha’s cloud-based platform for retail traders to create and deploy trading algorithms without coding is an innovative solution that allows you to backtest them on historical data. They include:

- You can write your strategies in English and the platform translates them into coding.

- Develop a strategy utilizing 60+ indicators.

- All of your strategies can be backtested with up to five years on any instrument

- Deploy multiple strategies with a single click.

- Get notified and track live positions.

Zerodha Sensibull (Options Trading Platform)

Sensibull is the best stock trading platform with various brokers and the option to trade in several stocks. This includes companies like Axis Direct, Kotak Securities, Edelweiss, ICICI Direct and Karvy Broking etc.

With the Sensibull platform, you can create a list of strategies based on your market view. For example, let’s say that you think the SBI share price is going to stay between 280 and 300 this week. But maybe you’re not sure which option strategy to deploy in order to profit? Sensibull will give suggestions with a list of strategies for what type of options are available at different strikes and expiries, their potential return rates as well as the risks involved in each strategy! You can also customise these strategies by tweaking or changing parameters depending on your needs. Other features include:

- To find the best option strategy, compare them and see which is better.

- Analyze the trades and positions you are in.

- Options strategy builders

- Trade events calendar to keep track of major events that may impact your trade.

- Access to the enhanced option chain

- Ordering is made easy, with no need to talk to anyone.

- Options Analyzer for in-depth analysis of contracts.

- Futures & Options contract screeners

- This trading facility is a simulation.

Zerodha Goldenpi

GoldenPi is an India-based company that provides customers with a way to invest in bonds and debentures from the comfort of their homes. With access to different types of bond investments through partnerships, GoldenPi makes it easy for you as a customer to make all relevant purchases right on the site! The features include:

- Online access to over 3000 Crores worth of Bonds is possible.

- Zero investment commission.

- Get real-time updates on the incoming interest payments.

- You can invest in bonds for as little as ₹ 10,000.

- Round-the-clock assistance from a dedicated team.

- A goal-based investment process

- Demat account opening assistance.

Zerodha Trading Tools

Zerodha offers various trading calculators to its customers. These calculators are useful in quickly calculating brokerage fees and margins, among other things. Zerodha also provides a range of online trading tools including

Brokerage Calculator: This brokerage calculator can help you calculate the profit of a trade by giving you a complete breakdown of fees, taxes and other charges.

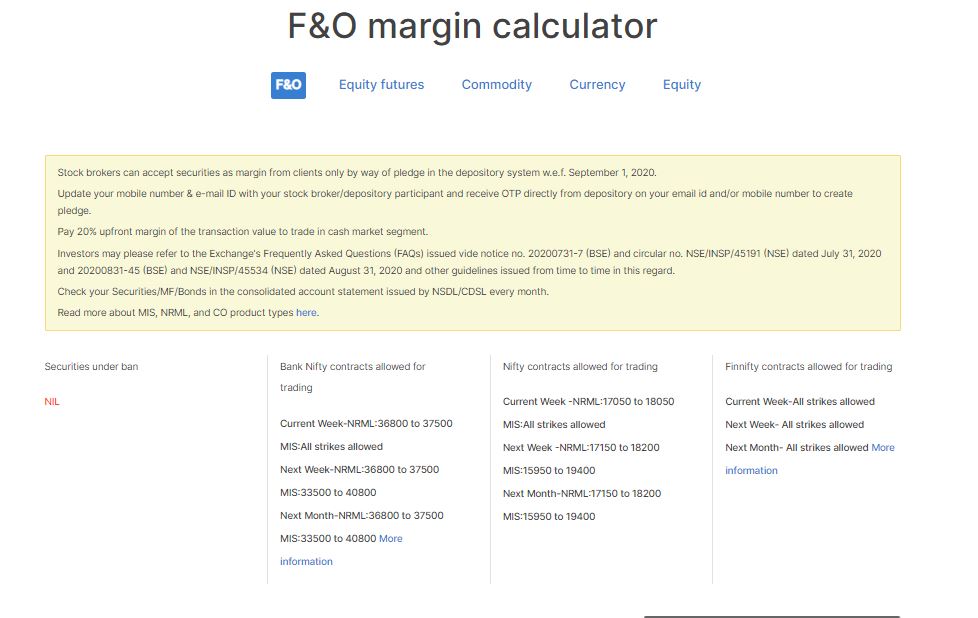

Margin Calculator: This tool helps you calculate the various margins needed – namely, the span margin, exposure margin, and total margin – so that you know how much money should be on hand at all times.

Black Scholes Calculator: The Black-Scholes Calculator is designed for traders of options, and can be used to calculate the premium, as well as various option “greeks” that influence how an option’s price changes.

Pi Expert Advisors: Advisor is an app that allows you to code your technical analysis strategy without coding. It will also backtest the strategy and show its past performance, then take it to live on Pi Expert Advisors. It generates real-time buy/sell signals for the strategy once live.

How To Open Demat Account With Zerodha

Zerodha has made a name for itself, and it is not surprising that you would already be interested in them and would want to join them as a trader.

That is why, In that case, you just need to take care of the following to open a Demat Account:-

- Visit the Zerodha website

- Click on the Zerodha signup button

- After entering your mobile number, click continue.

- Confirm your mobile number by entering the 6-digit OTP received on your phone number.

- Enter your 6-digits OTP on your email id to verify your email address.

- Click on accept and continue to enter your PAN No. and date of birth.

- Use UPI to pay the account opening fees or through Net banking.

- To share your Aadhar details with Zerodha, login to your Digilocker account.

- Enable Zerodha to access your Aadhar details.

- Fill in your personal details and background information.

- Read all the instructions, check all the boxes, and continue.

- Place the OTP generated by the online In-Person verification (IPV) into a piece of paper and hold it in front of a camera to complete the paper-based online In-Person verification (OPV).

- Upload all the required documents, such as a Pan card, an Aadhar card, a cancelled cheque, a photo ID proof, and income proof (mandatory for derivatives trading & commodity trading).

- Complete E-sign with aadhar

- Enter your security code to verify your Email ID.

- Click on Sign Now to complete the account opening form.

- Enter your Aadhar Number and click on Submit to create an online account.

Zerodha's Advantages & Disadvantages

Advantages of Zerodha

Zerodha has a lot of advantages. Here are Zerodha’s Pros and cons will tell you if it’s the right investment for your needs.

- Zerodha is the most popular broker in India, with the largest number of active clients and a high volume of daily trading.

- Kite, Console, and Coin are the best trading platforms in the industry.

- Equity Delivery Trades involve a cash-and-carry transaction. There is no brokerage cost associated with this purchase of shares, and the delivery trade has no leverage. Once the shares are bought, they will be delivered to your Demat account for storage if sold; otherwise, the sold shares will be debited from your account.

- India’s cheapest share broker is an online trading platform that provides services at a simple zerodha pricing model. It charges either 0.03% or Rs 20, whichever is lower, per executed order and the maximum brokerage paid by the customer on each trade is also Rs 20.

- Zerodha Referral Program – refer a friend and earn 10% of their transaction fee.

- Zerodha is a self-clearing broker and the customers don’t have to pay any clearing charges.

- Zerodha has simplified brokerage plans that can be paid peruse. Zerodha does not have any prepaid brokerage plans available.

- Zerodha GTT orders Place long-term stop losses and target orders for your stock investments.

- Zerodha Kite 3 Mobile – An all-new mobile app built for both passive investors and active day traders with significant user experience enhancements.

- Apply for your new IPOs (Initial Public Offerings) directly with Zerodha and get access to the latest IPOs.

Disadvantages of Zerodha

There are many cons or drawbacks to Zerodha. These include:

- They don’t offer advice on stocks, research reports or recommendations.

- We do not offer monthly unlimited trading plans.

- AMC Demat account plans with lifetime free subscriptions are not available.

- If a customer is not interested in fulfilling their MIS/BO/CO position, the Customer will be charged Rs 50 per executed order.

- An additional charge of Rs 50 per fulfilled order applies for Call & Trade.

- Zerodha doesn’t offer banking services, so the 3-in-1 trading account isn’t available.

- Unlike other providers, Zerodha’s trading platform is not integrated into its back-office Data updates in the back office will be updated overnight.

- The BSE SME IPOs are not available. The NSE SMEs are available.

Zerodha Review: Final Thought

Zerodha itself, is a live vision of the future. They have well deserved their success and will continue to evolve to be even better! Zerodha is ceaselessly evolving and this is what makes it so successful- they are always striving for growth. They are an amazing brokerage house.