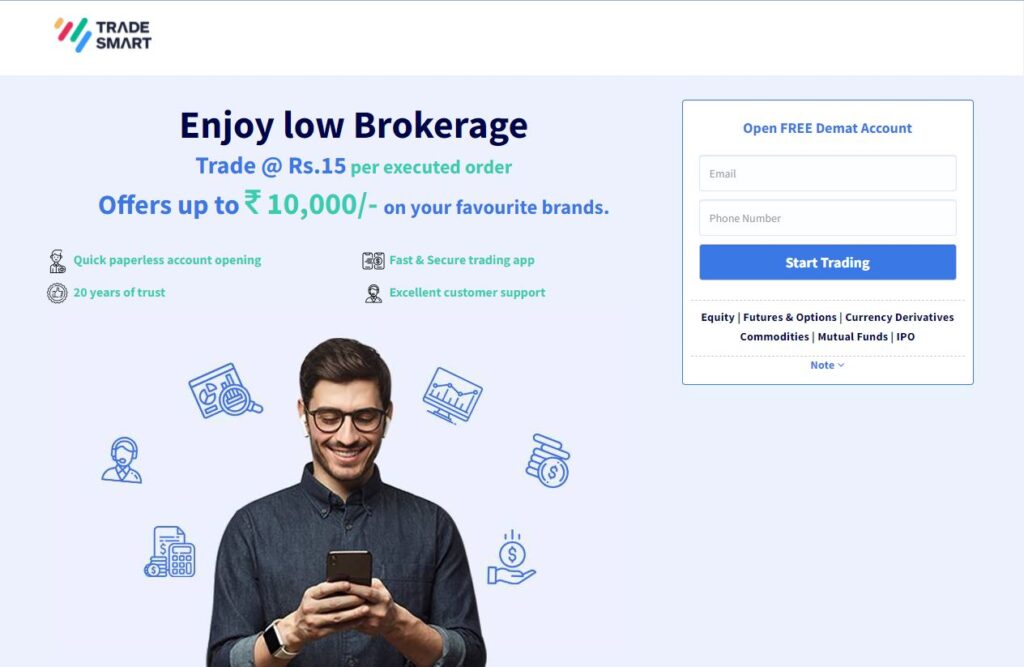

TRADE SMART REVIEW

Overview

VNS Finances is an NSE member since 1994 and has a strong presence in the financial services industry. Trade Smart was started in 1999 by My Vijay Singhania, who began as a discount broker.

In reality, VNS was more into full-service broking while Trade Smart had a history of deploying innovative technological solutions for its customers with their various trading platforms and services to provide seamless customer experience at competitive prices

Trade Smart clocks around Rs 2500 Crore worth of trade turnover daily with over 17000 happy customers!

Trade Smart has their centers at multiple locations in the country and thousands of Sub brokers who are responsible for increasing sales. Trading in any one of the following segments is possible: Equity, Currency, Commodity & Derivatives.

Trade Smart also offers a flexible trading software that’s registered with BSE (Bombay Stock Exchange), NSE (National Securities Exchange) and MCDX (Moneycontrol Domestic Ex-Listed).

Their versatile trading platforms have received many accolades from customers; moreover it attracts new traders every year because of these features as well.

Overview | |

Company Type | Private |

Broker Type | Discount Broker |

Headquarters | Bangalore, Karnataka |

Founder | Vijay Singhania |

Established Year | 1999 |

Trade Smart Account Opening Charges

Demat Services | |

Depository Source | CDSL & NSDL |

Account Opening Charges | Rs.400 |

Demat AMC Charges | Rs.250 per Annum |

Trading AMC Charges | Free |

Margin Money | Zero-Margin |

Offline to Online | No |

Trade Smart is a discount broker that offers trading and Demat account services. Customers can opt to open Trading Accounts or Demat accounts, with the latter costing Rs 250 per annum in maintenance cost while there is no such charge for Trading Account holders.

To get started with Trade Smart one would need only to register as an investor; this will be done at a fee of 400 rupees per account (the same for both types). There are no charges if you want to open up either type of investment service,

but there will always be some form of maintenance fees due when it comes down to month-to-month operations like withdrawals or deposits – these apply equally regardless of the type you decide upon opening.

How To Open Demat Account With Trade Smart Online?

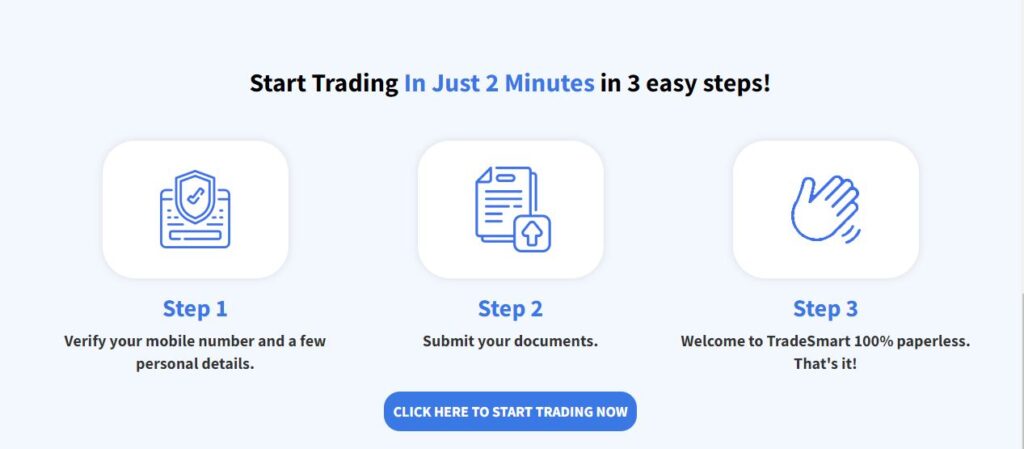

Trade Smart Online has a tab on their homepage that says “Open Trading Account.” Once you click on this, the process is very easy and simple. They ask for your name first, then email address so they can look up your account type – here it’s called Investor Type – from there.

All you have to do after that is choose an account number and password which must be at least 8 characters long with uppercase letters (A-Z), lowercase letters (a-z) numbers(0-9) and symbols!

- When you fill out the registration form online, it requires all your details like full name, contact number, email address, address (and any alternate addresses),

- Annual income if self-employed or salaried and bank account information. It also requires your PAN number and Adhaar card number in order to complete this transaction.

- Once you fill all the required details, the system will prompt you to upload your KYC documents. The following are necessary for account opening:

-self attested copy of PAN card (1)

-Self attested copy of any one out of these 2 documents as

- Address Proof

- Aadhar Card or Ration Card

Trade Smart Online Brokerage Charges

Brokerage Charge & Fees | |

Equity Delivery Trading | Rs.15 per Executed Order |

Equity Intraday Trading | Rs.15 per Executed Order |

Commodity Options Trading | Rs.15 per Executed Order |

Equity Futures Trading | Rs.15 per Executed Order |

Equity Options Trading | Rs.15 per Executed Order |

Currency Futures Trading | Rs.15 per Executed Order |

Currency Options Trading | Rs.15 per Executed Order |

Minimum Brokerage | Rs.15 |

Demat AMC Charges | Rs.250 per Annum |

Trading AMC Charges | Free |

Margin Money | Zero-Margin |

Brokerage Calculator | Trade Smart Online Brokerage Calculator |

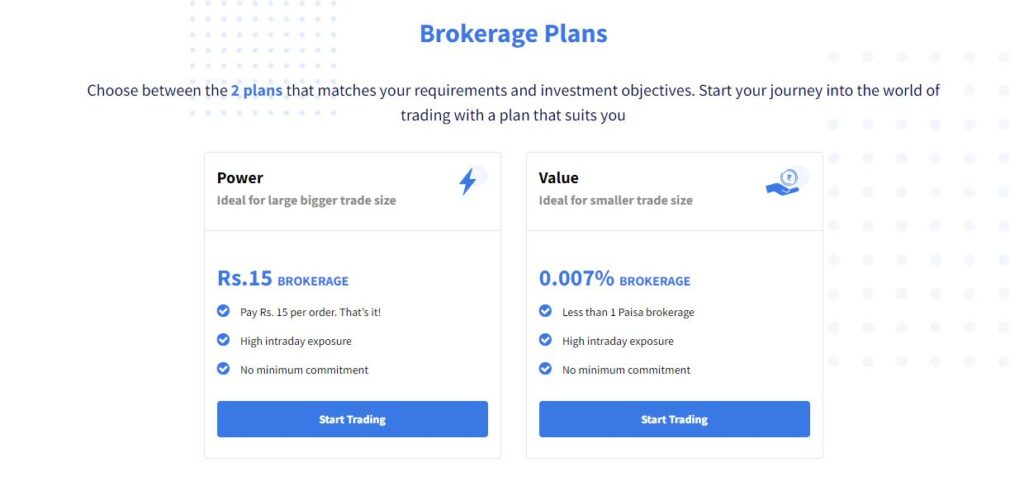

Trade Smart Online, being a Discount broker, has come up with two types of brokerage plans depending on your trade volume and frequency. They have one plan for lower volume traders and the other for higher-volume traders.

In the Lesser Volume plan they charge as per a percentile of your trade amount – 0.007% percent or less than that if you’re trading equity Intraday Trading in stocks (Futures Trading), Currency & Commodities (stocks). Anything above this is charged at 0.07%

Options trading will cost Rs. 7 per lot, irrespective of the order amount. That’s the percentile standard charge for a less frequent trader with low volume transactions and also not much value either.

However, high volume traders have a Standard Charge of Rs. 15 per executed order which is charged to them no matter what trade value there is- so even if you are trading worth 1 Lac or 10Lac or 1 Crore, it would be the same for any single order (and hence your margin money doesn’t stay on account).

This kind of plan has many benefits – like one can trade without paying an opening fee and they want as many people to join their system as possible so there’s zero Margin Money required from either party involved too!

Trade Smart Online Margin Exposure Or Leverage

Exposure / Leverage | |

Equity Delivery | Up to 2X |

Equity Intraday | Up to 30X |

Equity Futures | Up to 7X |

Equity Options | Up to 7X |

Currency Futures | Up to 5X |

Currency Options | Up to 5X |

Commodities | Up to 6X |

Margin Calculator | Trade Smart Online Margin Calculator |

Trade Smart offers customers plenty of leverage and exposure to enable smooth trading transactions and complete transparency. They offer the maximum exposure in Equity Intraday, up to 30 times the trade value; followed by Equity Futures & Options, with 7 times more initial investment available.

For commodities they provide 6 times worth of risk management than their original trade–and for Currency futures and Options there’s 5-times as much at stake per transaction than what you put up front.

This heavy kind of exposure clearly means that Trade Smart wants lots of customer participation who are no doubt willing to trade more each day.

Trade Smart Other Charges

Other Charges | |

Transaction Charges | 0.00300% of Total Turnover |

STT | 0.0113% of Total Turnover |

SEBI Turnover Charges | 0.0007% of Total Turnover |

Stamp Duty | Depends on State (very minimal) |

GST | 18% of (Brokerage + Transaction Charges) |

Trade Smart charges transaction, brokerage, and tax rates that are a little higher than the industry average. They charge 0.003% of total turnover value for transactions, 0.0113% on securities transactions and 0.0007% on SEBI turnover charges to cover the government mandates along with other taxes like GST which is generally 18%.

Why Open Trade Smart Online Trading Account?

The SEBI requires that every brokerage house should be a registered depository partner with some exchange. In order to begin trading, you need a Trading Account opened with Trade Smart.

If you are wondering why you should open your Trading Account here, then below are our reasons:

– You get personalised attention from the team of experts who work at Trade Smart

– We provide access to many different markets and products including equity derivatives, currency futures and commodities in India’s compelling market environment

– Our prices are competitive; we offer volume discounts as well as enhanced rebates on certain services like connectivity fees

Did you know that for over 25 years, we have been in the financial industry and found success? In addition to our large customer base, we offer flexible and low-cost brokerage plans matching your requirements.

Trading is a simple process of opening an account with us which doesn’t require any margin money or security deposit. The benefits are plenty including up to 60 times exposure during Intraday trading as well as 24/7 dedicated customer support team.

That’s not all! You can trade in multiple exchanges and segments at the same time when you make trades on behalf of other customers through our platform – this means Zero balance trading accounts only matters here.

Trade Smart Online Product & Services

List of products & services provided to its clients

PRODUCTS

Equity Trading | Yes |

Commodity Trading | Yes |

Currency Trading | Yes |

Options | Yes |

Futures | Yes |

Mutual Funds | Yes |

Forex | No |

Banking | No |

SIP | Yes |

Insurance | No |

Trade Smart Online does everything 200%. They offer the best and world-class products for their customers. When it comes to broking services, you can trade in all segments be it Equity, Commodity, Currency or Derivatives. You can even choose Intraday Trading Services with Options and Forex Trading as well!

Trade Smart is into Mutual Funds as well- they help grow your portfolio by keeping a close eye on that too! Come visit them for SIP Services which will also include Forex and Insurance products at our store today

SERVICES

Demat Services | Yes |

Trading Services | Yes |

3 in 1 Acount | No |

Intraday Services | Yes |

IPO Services | Yes |

Stock Recommendations | No |

Robo Advisory | No |

PMS | No |

Trading Institution | No |

Trading Exposure | Up to 30X |

Trade Smart is not just a discount broker; they also provide all services like a Full-Service broker. Demat account, Intraday Trading Account & Delivery Services are being offered by them for the customers too. They also offer exposure of about 30 times the amount deposited in case of IPO investments.

Trade Smart Online Offers

OFFERS

Free Demat Account | No |

Free Trading Account | Yes |

Discount on Brokerage | Yes |

Trading Happy Hours | No |

Flexible Brokerage Plans | Yes |

1 Month Brokerage Free | No |

Holiday Offers | No |

Referral Offers | Yes |

Zero Brokerage for Loss Making Trades | No |

Trade Smart Online, as the name suggests, is a very smartly driven organization. They offer flexible brokerage rates and discounts on brokerages for their customers- depending upon how much they use them!

As an added bonus to those who refer friends and family members (and get referral benefits), there are trading points and cash rewards as well.

Trade Smart Online Trading Platforms

TRADING PLATFORMS

Desktop Platform – Windows | Yes |

Desktop Platform – Mac | Yes |

Desktop Browser Platform | Yes |

Mobile Site Platform | Yes |

Android App Platform | Yes |

iOS App Platform | Yes |

Windows App Platform | No |

Other Mobile OS Platforms | No |

Real-time Updates | Yes |

Portfolio Details | Yes |

Online MF Buy | Yes |

News Flash | Yes |

Research Reports | No |

Easy Installation | Yes |

Global Indices | Yes |

Stock Tips | Yes |

Personalized Advisory | No |

Interactive Charts | Yes |

Live Markets | Yes |

SMS Alerts | No |

Email Alerts | Yes |

Multi-Account Management | No |

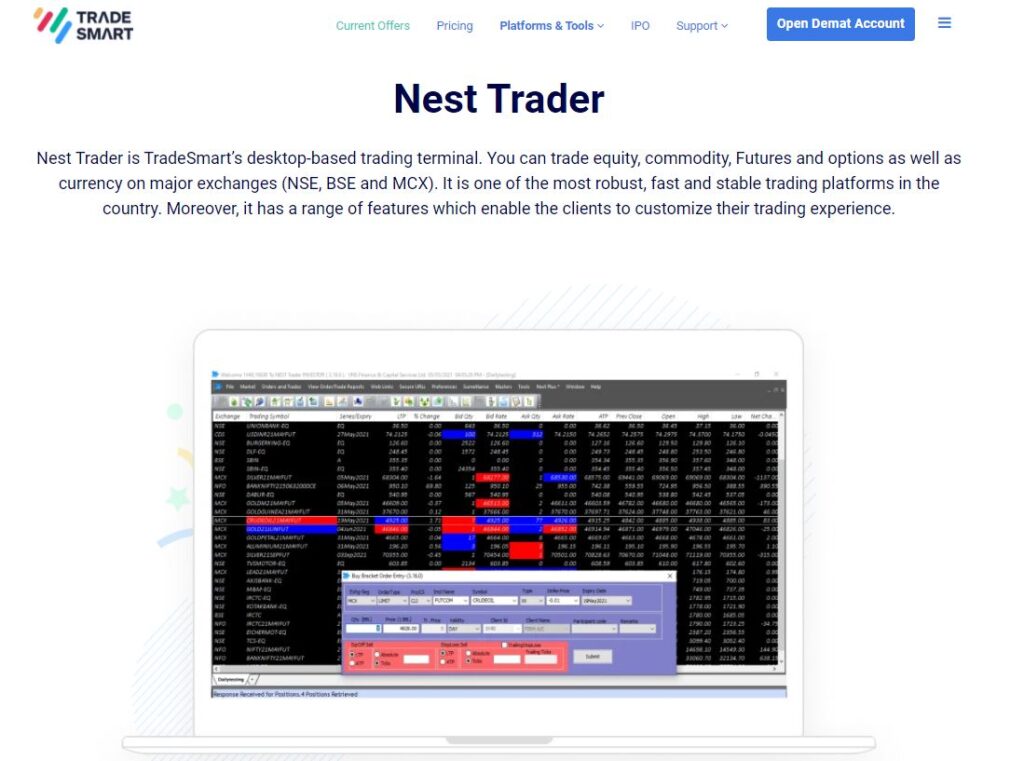

Trade Smart Online has three distinct types of trading platforms:

- Trader

- Mobile-based

- Browser-based

Trade Smart Online Trading Terminal :

This is a desktop-based platform that any user can download and use from their computers. It has certain features like bulk order entry, access to over 26 banks for funds transfer, high-speed performance and excel-based reports of the market’s performance.

The system also provides arbitrage watch on the market’s movements from time to time. There are basket trading options available as well.

Trade Smart Online Browser Based Trading Platform

- Trade Smart’s web-based trading platform has many benefits:

- Flexibility to trade while travelling.

- A seamless trading experience through the web-based platform with high-security features for data confidentiality and real-time updates on market watch.

- Customizable workspaces, portfolio management, and end to end.

Trade Smart Online Mobile Trading App

This mobile platform has given a lot of flexibility to traders. Some features are:

- All the features of the Desktop and Web platforms on this app

- Trade from anywhere across the globe, anytime you want

- Easy tracking of portfolios with the latest information

- Transfers funds directly from your phone account to over 26 banks without any hassle

Trade Smart Online Research Advisory & Stock Tips

RESEARCH & ADVISORY

Fundamental Reports | No |

Research Reports | Yes |

Company Reports | No |

Annual Reports | No |

Company Stock Review | No |

Free Stock Tips | Yes |

IPO Reports | No |

Top Picks | Yes |

Daily Market Review | No |

Monthly Reports | No |

Weekly Reports | Yes |

Offline Advisory | No |

Relationship Manager | No |

Trade Smart is not just a discount broker; they also provide all services like a Full Service broker. Demat account, Intraday Trading Account & Delivery Services are being offered by them for the customers too. They also offer an exposure of about 30 times the amount deposited in case of IPO investments.

Trade Smart Advantages & Disadvantages

Advantages Of Trade smart

The following are the advantages of TradeSmart. You must read TradeSmart advantages and disadvantages before opening an account with TradeSmart.

TradeSmart pros and cons help you find if it suits your investment needs.

- 2 Different Brokerage plan – Company provides 2 unique brokerage plans designed in such a way that it suits every trading strategy.

- Up to 30X exposure in NSE cash and 7X limit in Equity Futures and Option selling through BO & CO. 6X limit in MCX through CO & BO.

- Bracket order(BO) and Cover order(CO) available on mobile app. BO and CO are available in the Equity Derivative segment, NSE cash and commodity Futures.

- Interchangeable Brokerage – TradeSmart provides flexibility to switch over from one brokerage plan to another, depending upon their strategy.

- Lowest transaction cost – As per their brokerage calculator, the Transaction charges (turnover charges, clearing charges etc) are one of the lowest in the industry.

- Customer Service – Excellent customer service. Client could connect to TradeSmart customer support desk through phone, live chat and email ticketing.

- Referral credit – TradeSmart offers to its customers, 10% credit of the brokerage generated by the clients referred by them. Also, they have Partner program with higher sharing.

- No minimum amount balance – TradeSmart do not require any minimum amount to open an account.

- TradeSmart has its own depository services. This is unlike most other discount brokers in India.

- TradeSmart offers customer support though ‘Live Chat’. This is convenient to many customers who doesn’t want to call for simple issues and help.

- Cover Orders are available for traders.

- Provides Mutual Funds and Offer For Sale (OFS)

- Provides Margin against Shares (MAS)

Disadvantages Of Trade Smart

The following are the cons of TradeSmart. Check the list of TradeSmart drawbacks.

- Call & Trade is charged at additional Rs 20 per trade.

- Intraday positions (MIS, CO & BO) squared off by RMS team is charged Rs 20 per trader extra.

- Doesn’t provide 3-in-1 (Bank, Trading, Demat) accounts, portfolio management services, tips & research report and online IPO.

Trade Smart Online Customer Support

CUSTOMER SUPPORT

Dedicated Dealer | No |

Offline Trading | No |

Online Trading | Yes |

24*7 Support | No |

Email Support | Yes |

Chat Support | No |

Toll-Free Number | No |

Branches | Zero |

Trade Smart Online has a customer support team to help you anytime, any time. They have a customer service desk that you can reach out to and they are also available by email as well as chat box on their website.

Trade Smart Compliants & Feedbacks

COMPLIANT (CURRENT YEAR)

Lodged in BSE | 56 |

Resolved in BSE | 53 |

Lodged in NSE | 75 |

Resolved in NSE | 73 |

Trade Smart too receives customer complaints and that becomes a reason for the company to get better every time.

This year as well Trade Smart has received some complaints but they were able to resolve most of them instantly after talking to the customers.

53 out of 56 lodged in BSE have been resolved, and 73 out of 75 filed in NSE have also been successfully resolved.

Trade Smart: Final Thought

Trade Smart Online has been providing various dynamic and versatile services to its customers for a very long time. If they continue doing so with their platforms and services, then Trade Smart will be the top brokerage house in India