BASAN REVIEW

Overview

Basan Equity Broking Pvt Ltd is a reputable Indian company that has been operating since 2007. It also provides clients with full service and offers stock brokerage services as well.

Basan Equity Broking is an internationally recognized provider of stock trading platforms, and they have been providing essential services for over a decade.

They have 152 positive reviews, which is a good indication of their user experience with customers. They respond quickly to orders, and never fail to amaze traders but they lack promotional offers that would help them among those who trade more frequently.

Basan is a company with the best trading platform in India and 202 branches across the country. They have a team of people who help teach new investors about stock investing strategies. This is how they’ve been successful for more than 10 years now.

OVERVIEW | BASAN |

Company type | Private |

Broker type | Full-service broker |

Headquarters | Hyderabad, A.P |

Founder | Basanth Agarwal |

Established year | 2007 |

Basan is the leading brokerage firm in India. Their service offers a range of features and costs only ₹299 per year for AMC on Demat accounts- what are some benefits? The corporate has 5x commerce exposure which is below average; eventually, it became an all-inclusive broker with Mr Agarwar at its helm. Its headquarters are found in Hyderabad, where many evolutions happened thanks to him! To open a Basic Broking account with Basan costs ₹100, as well as CDSL & NSDL, being dematerialization contributors. To open an account with them online also costs just ₹100 and they offer dematerialization on their website too.

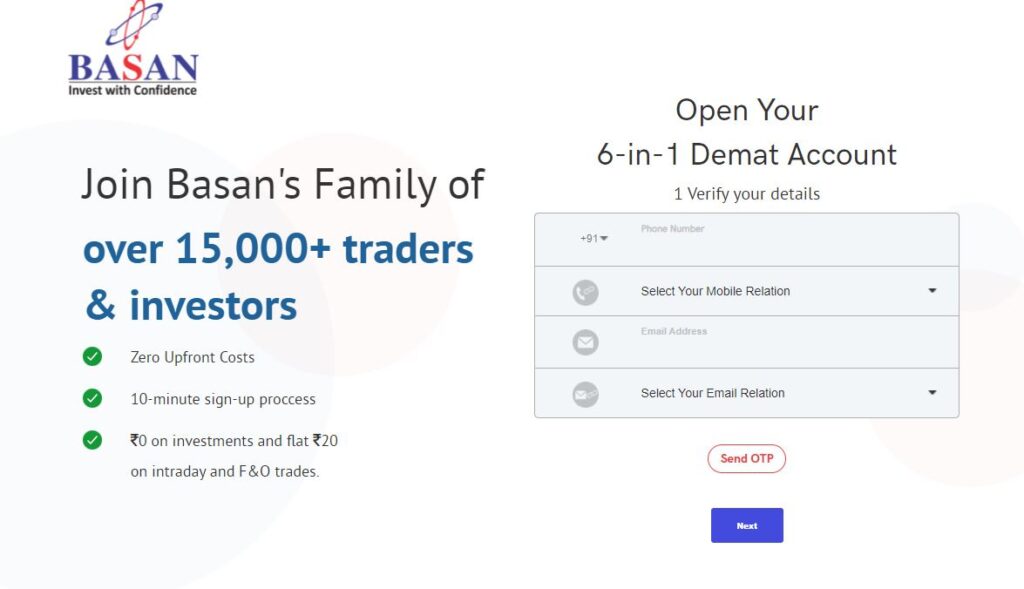

How To Open An Basan Equity Demat Account

If you have made the decision to open a Basan Equity Demat Account, here are the steps.

- Click on the button that says “Open Demat Account” which is provided below and fill out the pop-up application.

- The person from Basan Equity will contact you for a call and assist with getting your KYC sorted. The assistance can be found on the portal if you complete their EKYC process online.

- To open this account, you will need a PAN card, an Aadhar card and bank account details.

- In order to open a Demat account, you must fill out an application form with your details. If you’re filling this information in online through Aadhaar, it becomes easier once all the AADHAAR info has been filled out.

- Some information is needed before filling in your bank account details, like the IFSC and account number. All of this will be safely stored in our records.

- To register for a new account, upload scanned copies of your Aadhar card and PAN card along with your photo. The Basan Equity executives will contact you once they receive your documents, assisting in the rest of the steps after which it’s an easy task to open an account.

- When you create an account, the confirmation process is complete and you can login with the credentials we provided to you via email. You are now ready to start trading.

Basan Account Opening Charges

To open a Basan Equity Broking Demat account, one has to pay ₹100. The depository participants involved are CDSL and NSDL, which charge an AMC of ₹300 per annum for the demat account. They also deal with trading accounts that come free of any charges as long as there is dematerialization; it’s available at an additional fee, costing only about₹150! It’s no surprise that they have set a minimum margin money requirement-it starts from €500 or Rs 5 lakh for small lot trading or even more than this if you are looking to trade in shares (premium). Moreover, opening up your brokerage online stock broker near me account comes with its own upfront costs too and those who wish to trade in stocks here will always have much higher brokerage fees amounting up to even 25 lakhs (premium).

CHARGES | BASAN |

Depository source | CDSL & NSDL |

Account opening charges | ₹ 100 |

Demat AMC charges | ₹ 299 per annum |

Trading AMC charges | Free |

Margin money | Minimum ₹5000 |

Offline to online | Yes |

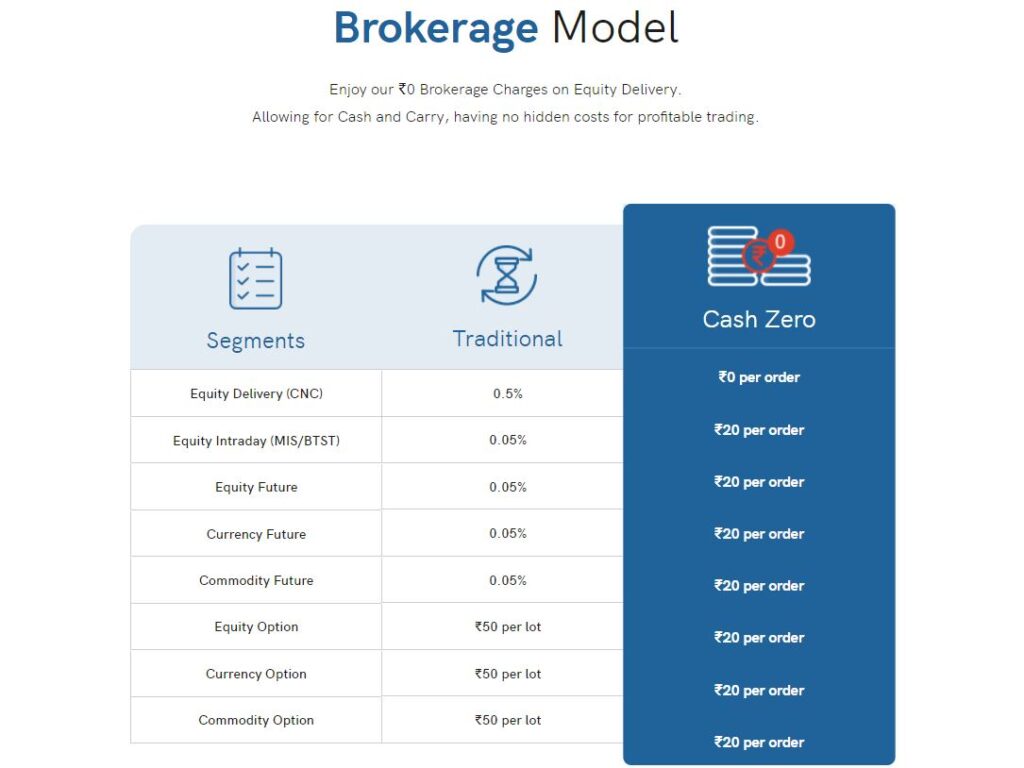

Basan Equity Brokerage Charges

The brokerage charges are as follows:

SEGMENTS | CHARGES |

Equity delivery | 0.003 |

Equity Intraday | 0.003 |

Commodity trading | NA |

Equity futures | 0.0003 |

Currency futures | 0.0003 |

Currency options | ₹ 30 per lot |

Minimum brokerage requires | Percentage of transaction |

Demat AMC | ₹ 299 per annum |

Trading AMC | Free |

Basan Margin Exposure Or Leverage

SEGMENTS | MARGIN |

Equity delivery | Upto 2x |

Equity intraday | Upto 5x |

Equity futures | Upto 2x |

Equity options | Upto 5x |

Currency options | Upto 3x |

Commodity trading | Upto 2x |

Other Charges

Apart from the brokerage, customers must also pay transaction charges to brokers for executing trades on their behalf. These are just some of the other charges that brokers levy:

CHARGES | FEES |

Transaction charges | 0.000032 |

SEBI charges | 0.0126% of total turnover |

SEBI turnover charges | 0.0002% of total turnover |

Stamp duty levied | Depend on the state (Very minimal) |

Basan Equity Offers

Free Demat Account | No |

Free Trading Account | Yes |

Discount On Brokerage | Yes |

Trading Happy Hours | No |

Flexible Brokerage Plans | No |

1 Month Brokerage Free | No |

Holiday Offers | No |

Referral Offers | No |

Zero Brokerage For Loss Making Traders | No |

Basan Equity Broking offers free account opening and an AMC, but not much else. It does offer occasional discounts on brokerage fees, but no Happy Trading Hours or Holiday Offers or referral programs. After this fact, traders don’t expect even flexible plans from top brokerages-they have to pay for everything such as deposits and withdrawals directly from their savings accounts in order to avoid brokerage fee charges. Overall, this section is definitely a weak point of theirs that they need to take care of if they want continued success in the industry.

Basan Equity Products & Services

Products offered by basan equity

This stockbroker offers a wide range of products and services.

Equity trading | Yes |

Commodity trading | Yes |

Currency trading | Yes |

Options | Yes |

Future | Yes |

Mutual funds | No |

Forex | Yes |

Banking | No |

SIP | No |

Insurance | Yes |

The company has a large selection of products to offer customers.

- Equity trading

- Commodity

- Currency

- Derivates

- Forex

- Insurance

Basan equity services offering

Demat services | Yes |

Trading services | Yes |

3 in 1 account | No |

Intraday services | Yes |

IPO services | Yes |

Stock recommendations | Yes |

Robo advisory | No |

PMS | No |

Trading institution | No |

Trading exposure | Yes |

Basan Equity Broking is not only an online stock trading service provider; they also deal in commodities, loans and insurance. In addition to this, they offer derivatives, currencies, IPOs and mutual funds as well. They provide Demat account activities along with trading accounts’ activity too!

Apart from these services are their intraday and PMS offerings that come with a degree of maximum five-time exposure while providing periodic stock recommendations to its clients who haven’t been lucky enough yet to receive the three-in-one account offered by them now.

Basan Equity Annual Maintenance Charges

The Basan Equity AMC is an annual maintenance charge of Rs.299 per year which you need to pay in order to maintain your account. There are no other charges imposed besides this fee for the management of your account at Basan Equity.

However, the fee is only for maintaining your Demat account; there are no charges associated with your trading account.

Basan Equity Trading Account

Here are the benefits you can enjoy with your Basan Equity Trading Account:

- A major aspect of finance is being able to deal with different investment options, including stocks and bonds but also derivatives and currencies.

- Without any trouble, you can access your Basan Equity Trading account. They provide the best online trading platforms possible and you can easily trade in accordance with whichever platform is most suitable for your needs.

- To deal in shares, you will need to have a certain amount of money available. For example, Rs. 5000 must be your balance before stocks can be traded from it and with this sum on hand there should always be some funds leftover so that they can remain safe in the trading account.”

- You can buy into IPOs through the Basan Equity trading account, too.

- Bracket orders can also be used in addition to other order formats.

Basan Equity Trading Platform

Desktop platform – Windows Desktop platform – Mac | Yes Yes |

Desktop browser platform | No |

Mobile site platform | Yes |

Android app platform | Yes |

IOS app platform | Yes |

Multi-account management | No |

Window app platform | No |

Other mobile OS platform | No |

Real-time updates | Yes |

Portfolio details | Yes |

Online MF buy | No |

News flash | Yes |

Research reports | No |

Easy installation | No |

Global indices | Yes |

Stock tips | Yes |

Personalized advisory | No |

Interactive charts | No |

Live Markets | Yes |

SMS Alerts Email Alerts | No |

Basan Equity Broking Trading Terminal

Basan’s trading terminal is a Windows and Mac-compatible desktop application. It lacks an easy installation option, which makes it hard to install and something that every other rival company provides, as well as online MF Buy options–which are essential features for the best stock trading platform companies in this industry. Basan does offer some good but not enough features like News Flash reports, Real-time Updates and Portfolio Details reports but these can hardly compensate for its major flaws of having no easy installation or Online buy/sell feature.

Basan Equity Broking Web Trading Platform

Brokerage firms do not currently offer web-trading platforms to their clients

Basan Equity Broking Mobile App

Basan Equity Broking offers an app for traders to ensure that they have the best trading platform for beginners. It is available on their website and in both of the respective app stores: Android and iOS, with features such as charts, alerts etc. The only disappointment would be when comparing what they offer with competitors- email alerts are not offered but SMS notifications are available which might not be enough for some customers’ needs.

Basan Review: Final Thought

The Basan Equity Demat Account is one of the most hunted for accounts and that’s clear from a wide customer base. The reason for this is because they offer quality and quantity in their facilities, products, as well as trading terminals. This mainly happens thanks to their characteristically low brokerage- which means transactions are cheaper than usual – high-quality trading terminals too.