Aliceblue Review

Overview

Ever since its incorporation in 2006, Alice Blue has been serving stock and commodity traders with a range of services at BSE, NSE, and MCX. They also offer the convenience of opening a depository (Demat account) through their membership with CDSL.

AliceBlue offers a single flat fee brokerage firms plan to its customers, the F15. This means that it minimizes the brokerage fee so as to incur a lower cost for all trades carried out between you and your stock broker. The customer doesn’t have any fees per trade in this segment-it’s true discount brokering! Other segments charge Rs 15 or 0.01% whichever is lesser for executed orders.

Alice Blue Financial Services has 17 branches in major cities across India, as well as 1000+ partners. Their personalized broker service and wide range of partnerships make Alice Blue the perfect choice for anyone looking to start investing.

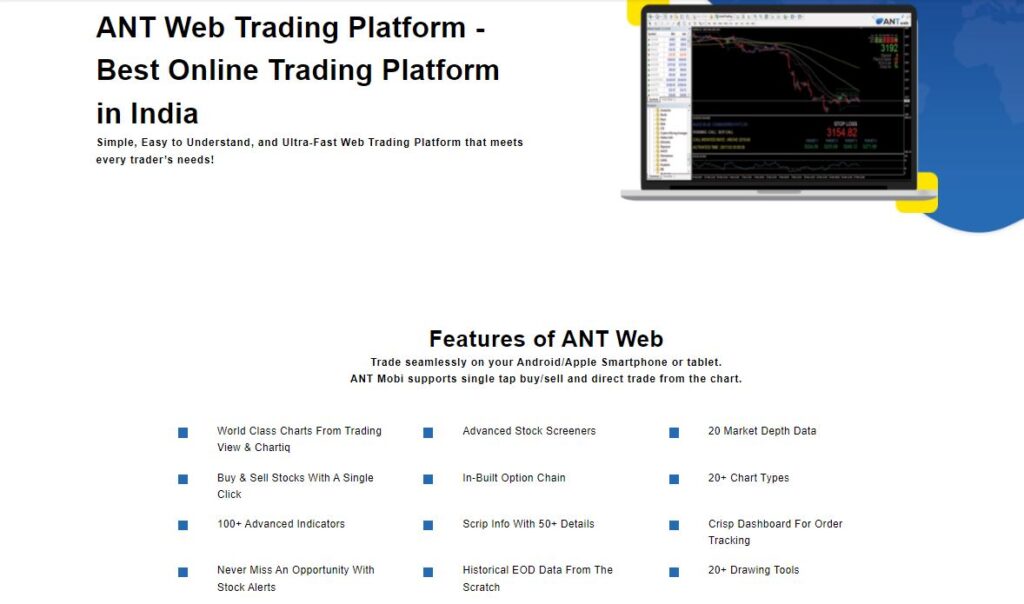

Alice Blue offers the best online trading platforms for its customers with ANT (Analyse and Trade) as the one it provides. It uses Omnesys NEST as a backend and is available in mobile, desktop and web versions. Alice Blue also offers ANT Meta or ANT Scanner to trade analysis software users to help them analyze their trades efficiently.

The discount broker offers access to proprietary and third-party trading tools for customers, including the Trade Store. Customers can get paid access to these tools on the ‘Trade Store’. The major trading tools available on the Trade store are:

Software Name | Description | Pricing |

Advisory Mandi | Customers can use a share market app to compare and select top experts and get trading advice from them. | Rs 499 |

Alice Algo | The Algo trading tool can be accessed through the web and app. | Subscription-based |

ANT IQ | A platform that enables you to build your own trading strategy using Fibonacci, indicators, and patterns. | Lifetime free |

Alice blue Mutual Funds | You can buy mutual funds through an online platform and get a zero brokerage fee with no transaction charges. | Zero for Aliceblue customers, only |

Sensibull | Options Strategy Builder and Trading Platform. | Lite: ₹ 600 per month Pro: ₹ 950 per month |

Smallcase | The pre-built portfolios are created around a trading theme or idea. | Buy Rs 100 smallcase. |

TickerTape | A tool for discovering and analyzing stocks. | Free |

Alice Blue Account Opening

You can open an account at AliceBlue in three convenient ways. You have the option to trade on BSE, NSE and MCX. They also offer a 2-in-1 Demat account (Dematerialized Account), which is helpful for all your trading needs.

Instant account opening – The best way to open an account is without any paperwork. Link your Aadhar number with the phone number you give for eKYC purposes, and submit it in order to allow instant trading and Demat account opening with no form filling.

Visit Alice Blue branch – Alice Blue Branch has over 15 branch offices located all across India. You can visit any of these locations to open an account with them.

Request account opening form – To open a new account, you can request the forms from customer service. These will be sent to your address and then you could fill out and send them back with payment within 24 hours of receiving the form.

Best brokerage accounts for trading in stock platforms, currency pairs or other assets are opened within 24 hours of receiving all required documents from the client.

Alice Blue Opening Charges

AliceBlue’s Bank-Opening Charges and Annual Maintenance Charges

Transaction | Fees |

The trading account opening charges | ₹ 0 (Free) |

Trading Annual maintenance charges (AMC) | ₹ 0 (Free) |

Trading Annual maintenance charges (AMC) | ₹ 0 (Free) |

Demat Account AMC (Annual Maintenance Charges) | ₹ 400 |

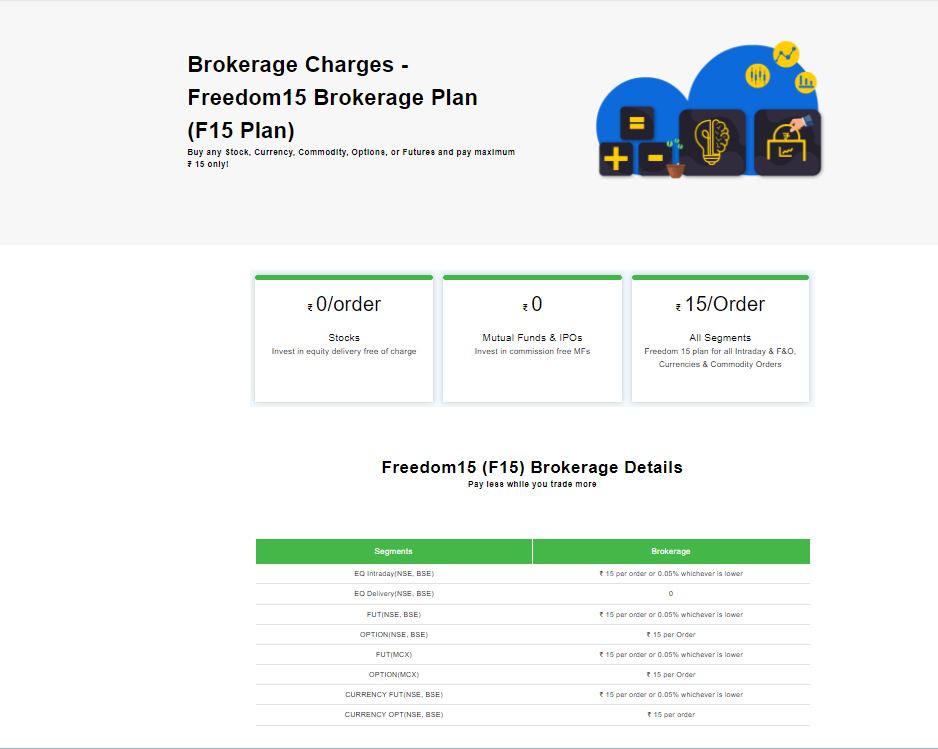

Alice Blue Brokerage Charges

Alice Blue Brokerage and Fees.

Transaction | Fees |

Equity delivery brokerage | ₹ 0 (Free) |

Equity intraday brokerage | Rs 15 or 0.01% whichever is lower |

Equity future brokerage | Rs 15 or 0.01% whichever is lower |

Equity option brokerage | ₹ 15 per order |

Currency futures brokerage | Minimum Rs 15 for orders or 0.01% of the order, whichever is lower. |

Currency option brokerage | ₹ 10 per order |

Commodity future brokerage | Rs 15 or 0.001% of the order, whichever is lower |

Commodity options brokerage | ₹ 15 per order |

Alice Blue Brokerage Fee Explained

Equity Delivery and Intraday

Alice Blue Charges | Equity Delivery | Equity Intraday |

STT | 0.1% on both the buy and sell-side | Sell-side transactions are 0.0025%. |

Transaction / Turnover Charges | NSE Rs 325 for every crore / BSE Rs 325 per every crore. | NSE: ₹ 325 for a crore BSE: ₹ 325 for a crore |

Goods & Services Tax (GST) | 0.0001% (₹ 10 crores) | 18% of the brokerage fee and transaction cost. |

SEBI Charges | 0.0001% (₹ 10 crore) | 0.0001% (₹ 10/Crore) |

Stamp Charges | State-wise | State-wise |

Equity F&O Brokerage

AliceBlue F&O Brokerage | Futures | Options |

STT | 0.01% on sell-side | 0.05% on the sell-side (On premium) |

Transaction / Turnover Charges | NSE Rs 190 per crore BSE Rs 190 per crore | NSE: Rs 5000 per crore BSE: Rs 5000 per crore |

Goods & Services Tax (GST) | 18% on (Brokerage + Transaction Fee) | 18% on a Brokerage and Transaction Charge |

SEBI Charges | 0.0001% (₹10/crore) | 0.0001% (₹ 10/crore) |

Stamp Charges | State-wise | State-wise |

Equity F&O Commodity Brokerage

Alice Blue Charges | Currency Options | Currency Futures | Commodity |

STT | No STT | No STT | 0.01% on the sell side (Non-Agri) |

Transaction / Turnover Charges | BSE will charge Rs 2000 per crore for premium memberships (0.02%). | BSE ₹200 per crore | Non – Agri ₹260 (0.0026%) / Agri ₹260 per crore |

Goods & Services Tax (GST) | 18% will be charged on (Brokerage cost + Transaction fee). | 18% on (Brokerage + Transaction Charge) | 18% on (Brokerage +Transaction charge) |

SEBI Charges | 0.001% (₹10/crore) | 0.001% (₹10/crore) | |

Stamp Charges | State-wise | State-wise | State-wise |

Alice Blue Margin Exposure

Alice Blue offers a margin that is up to 5 times leverage and 20% on intraday trades. Additionally, it has higher margins when trading equity, currency, and commodities at BSE NSE MCX without having any additional charges for carrying forward positions or delivering equity.

Segments | Margin | Leverage |

Equity Delivery | 100% of trade value | 1x |

Equity Intraday | Up to 20% of trade value | 5x |

F&O (Equity, Commodities & Currency) | 100% of NRML margin (Span + Exposure) | 1x |

Alice Blue Other Charges

- Brokerage fees are the charges brokers make for providing trading services.

- STT: This government tax is only applied to the sell-side of intraday and F&O trades, but it’s also applicable on both sides in Delivery trades for equities.

- Exchange transaction charges are fees charged by the exchange in some cases, but they can also include professional clearing charges.

- GST (Goods and Services Tax) is charged at 18% of the brokerage fee plus transaction charges.

- SEBI is imposing a flat-rate tax of Rs 10 per crore.

- Stamp duty is a type of government tax that varies depending on the state in which you live.

Other Charges (Alice Blue Hidden Charges)

- There is an additional charge of Rs. 20 per executed order when you use Call & Trade/Square Off.

- The delivery charges for equity transactions depend on the size of the transaction. It is Rs 15 per transaction

- The standard National Stock Exchange fee will be charged, as well as transaction fees and statutory levies.

Alice Blue Trading Platform

Brokers offer a variety of trading platforms, including desktop and mobile terminals, as well as an Alice blue online website.

The company’s various platforms are known as ANT or “Analyze and Trade”, which can be accessed from all devices, including desktops, web browsers, and mobile.

The Omnesys NEST platform has its own trading tool, called TradeLab. It is found in many Indian brokers like Zerodha and SAS Online too. The back-end tools used for ANT’s trade management system are products from Omnesys.

Desktop platform – Windows Desktop platform – Mac | Yes Yes |

Desktop browser platform | Yes |

Mobile site platform | Yes |

Android app platform | Yes |

IOS app platform | Yes |

Windows app platform | Yes |

Other mobile OS Platform | No |

Real-time platform | Yes |

Portfolio details | Yes |

Online Mf buy | Yes |

News flash | No |

Research reports | Yes |

Easy installation | Yes |

Global indices | No |

Stock tips | No |

Personalized advisory | Yes |

Interactive charts | Yes |

Live markets | Yes |

SMS alerts Email alerts | Yes Yes |

Multi-account management | Yes |

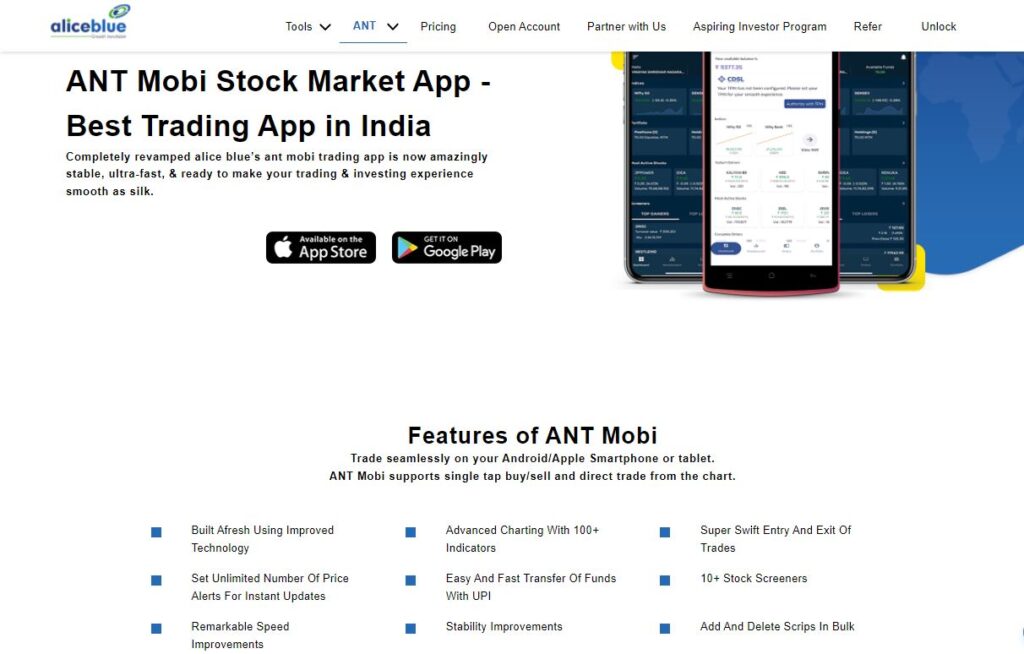

Alice Blue Mobile Trading Application

The Alice Blue app is available for both tablets and Android smartphones. It pulls information on equity, commodities, and currency trading straight from your phone. With this app, you can keep track of all the orders you’ve made or have been assigned to make as well as account limits with one quick search. There are a lot of features but it has encountered some issues during periods where there’s a heavy activity in the market place-it may not work or hang up on its own sometimes too if internet speeds are slow.

- There are 15 different types of charts available in the various time frames.

- Multiple types of orders are offered here, including Regular, Cover, Order and AMO.

- There are about 65 technical indicators.

Alice Blue Desktop Trading Application

ANT Desk is a mainstream and customizable trading application that can be downloaded to any computer or laptop. It has various advantages over traditional software, such as taking up less space and requiring only one terminal instead of multiple terminals. ANT Desk also provides advanced charts in both live time data as well as historical data when comparing it with other products on the market.

The ANT Desk offers a number of features, including the following:

- There are a variety of charting tools available on both intraday and historical levels.

- We offer Aftermarket Order (AMO) options.

- The real-time market quotes from BSE, NSE, MCX and other exchanges.

- The market research report is updated on a daily basis.

- With risk management tools, we can help you identify and manage risks.

ANT WEB / Alice Blue Trading Terminal

ANT Web Portal offers a variety of services for trading, including an ANT Scanner that filters the best stock trading platform on their website. Additionally, customers can download the software onto their desktops or mobile devices for easy access. Omnesys Technologies also provides NEST terminal-based software with several features:

- We provide up-to-the-minute monitoring of the stock market and multiple markets.

- Customers can place aftermarket orders through the website.

- Sign up to receive our alerts and stay updated on the latest news, notifications, and updates.

- The admin tool is a great way to set your default values and auto-square off measurements to the nearest foot.

- The Advanced Computational Interface for Aliceblue Web Trading software is the tool that you need to trade more effectively.

Aliceblue Review: Final Thought

Alice blue online is a discount broker, and they have close to 1 Lakh clients. Despite this success, their volume of business still remains lower than other brokers in the same sector. They are looking at expansion plans that seem good- high rates of client closures over the next few years will be what Alice blue online expects. In spite of these drawbacks though, if you do some research about them versus other brokers out there who might offer better deals for you then Alice blue would make a very good choice as well.