SAS ONLINE REVIEW

Overview

SAS Online is the best discount brokerage firm that has been in existence since 1995. In 1996 they started offering their first services, which included a variety of different products like online a stockbroker and options as well as currency and commodities on the BSE, NSE, and MCX exchanges.

They also have over 50k+ active clients spread across multiple cities in India. They also have a daily turnover of more than ₹15,000 Crore and execute more than 1 lakhs order on the daily basis.

As long as people trade through them at least once a year, SAS will remove all account fees including the minimum deposit requirement which means negligible trading cost-effectively without any hidden costs or hassle involved.

SAS Online Offers

Offers | |

Free Demat Account | Yes |

Free Trading Account | Yes |

Discount on Brokerage | Yes |

Trading Happy Hours | No |

Flexible Brokerage Plans | Yes |

1 Month Brokerage Free | No |

Holiday Offers | Yes |

Referral Offers | Yes |

Zero Brokerage for Loss Making Trades | No |

As mentioned earlier, SAS Online used the referral policy as a tool for expanding its reach.

They offer referral policies that reward investors who refer other investors to register with SAS Online. The referrer earns 20% to 50%. The brokerage fee is charged by the referee’s referred friend on trade transactions they make from their account.

SAS Online Demat Account Opening Charges

Sr.No | Segment | Charges |

1 | Demat account opening | ₹200 |

2 | Annual Maintenance Charges | Individual – ₹200 Non-Individual – ₹500 |

3 | Dematerialization | ₹2/certificate + ₹35/Demat request/500gm (Courier Charges) |

4 | Rematerialization | (₹25/certificate or 0.05% * value) whichever is high + Depository charges |

5 | Transaction charges | ₹9/instruction + depository charges |

6 | Pledge Creation | ₹50/transaction |

7 | Pledge Invocation | ₹50/transaction |

8 | Pledge Creation confirmation | ₹0 |

9 | Pledge Closure confirmation | ₹0 |

10 | Rejected or Failed Transactions | ₹30/transaction |

11 | Demat Rejection | ₹35/ rejection/ 500 grams |

12 | SLB | ₹25 (Security Lending & Borrowing) + Depository Charges |

Opening an account with Demat AMC is free of charge, and the margin money is not required. This means that you can use this service to trade AMCs without having to worry about making any margin money.

Brokerage Charges

Sr.No | Segment | ₹999 Equity Plan Brokerage | ₹999 MCX Plan Brokerage | Flat Plan Brokerage |

1 | Monthly Fees | ₹999 | ₹999 | ₹999 |

2 | Equity Delivery | ₹0 | NA | ₹9/executed order |

3 | Equity Intraday | ₹0 | NA | ₹9/executed order |

4 | Equity Futures | ₹0 | NA | ₹9/executed order |

5 | Equity Options | ₹0 | NA | ₹9/executed order |

6 | Currency Futures | NA | NA | ₹9/executed order |

7 | Currency Options | NA | NA | ₹9/executed order |

8 | Commodity Futures | NA | ₹0 | NA |

9 | Commodity Options | NA | ₹0 | NA |

SAS Online Transaction Charges

Sr.No | Segment | Transaction Charges |

1 | Equity Delivery | ₹325/crore |

2 | Equity Intraday | ₹325/crore |

3 | Equity Futures | ₹220/crore |

4 | Equity Options | ₹5500/crore (Premium) |

5 | Currency Futures | ₹120/crore |

6 | Currency Options | ₹4500/crore (Premium) |

7 | Commodity | ₹360/crore (Non-Agri) |

These transactions are at risk without notice. Makesureyoutake all the precautions needed to protect yourself and your funds.

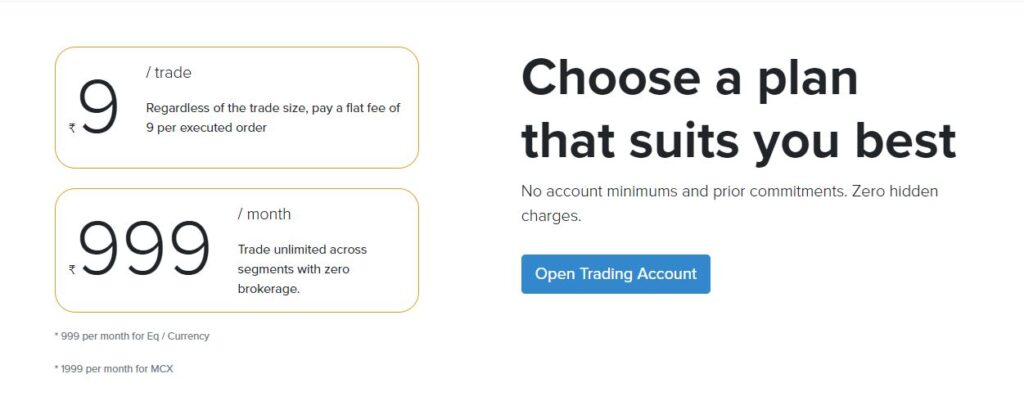

₹9/Trade Plan

This plan offers a flat rate of ₹ 9 per trade no matter the size of your trade. So you don’t have to worry about your trade size while executing the order. You will not be any extra amount if place a very big order. You will always be charged ₹ 9 for the trade. So, just focus on your trading game and leave the online brokerage responsibility to the SAS Online broker.

₹999 Equity Plan

SASOnline’s ₹999 Equity Plan is available at BSE Cash, NSE Cash, and NSE F&O. The plan offers unlimited trading in the equity segment for a flat ₹999 per month with no minimum deposit required.

₹999 Currency Plan

The ₹999 per month plan offers unlimited trading in the currency derivatives segment at NSE. There are no other charges involved in the plan.

₹1999 MCX Plan

₹1999 per month offers unlimited trading in commodities at the MCX stock exchange – with no hidden fees. You can trade as much as you want in this plan without worrying about the charges.

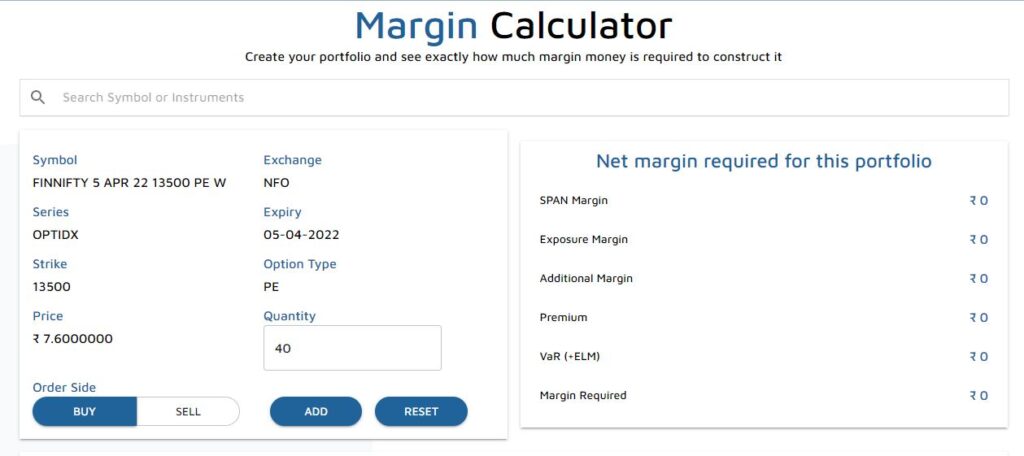

SAS Online Margin Exposure/ Leverage

Based on the stock and trading level, the margin for intraday online trading is 20% of trade value per day at a maximum leverage percentage of 5x. The intra-day margin for Forex & Commodity Trading (1.3x) can be earned by investing in options across BSE, NSE, and MCX only with no additional charge or deposit required. There is also no provision for carrying forward positions or equity delivery trades offered.

Sr.No | Segment | Margin | Leverage |

1 | Equity Delivery | 100% * Trade Value | 1x |

2 | Equity Intraday | Up to 20% * Trade Value | 5x |

3 | Equity Futures | 100% * NRML margin (Exposure + Span) | 1x |

4 | Equity Options | 100% * NRML margin (Exposure + Span) | 1x |

5 | Currency Futures | 100% * NRML margin (Exposure + Span) | 1x |

6 | Currency Options | 100% * NRML margin (Exposure + Span) | 1x |

7 | Commodity | 100% * NRML margin (Exposure + Span) | 1x |

SAS Online Other Charges

Demat

Remat

However, if you opt for remat services, you will have to pay Rs 25 per certificate or 0.05% of the value whichever is higher + Depository charges at actual 25 per certificate or 0.05% of the value whichever is higher + Depository charges at actual

Pledge

Charges for creating and closing pledges are ₹.50 per transaction, but you will be charged only ₹.50 if you invoke a pledge.

SAS Online Charges For Equity

Equity Delivery | Equity Intraday | Equity Futures | Equity Options | |

₹9/trade plan | 0.1% or ₹9/trade

(Whichever is less) | 0.01% or ₹9/trade

(Whichever is less) | 0.1% or ₹9/trade

(Whichever is less) | ₹9/trade |

₹999/month plan | ₹0 | ₹0 | ₹0 | ₹0 |

STT | 0.1% ( Buy & Sell Side) | 0.025% ( Sell Side) | 0.01% ( Sell Side) | 0.05% ( Sell Side) (Premium) |

Turnover Charges | ₹325/crore | ₹325/crore | ₹220/crore | ₹5500/crore (Premium) |

GST | 18% of (Transaction + Brokerage Charge) | 18% of (Transaction + Brokerage Charge) | 18% of (Transaction + Brokerage Charge) | 18% of (Transaction + Brokerage Charge) |

SEBI | ₹10/crore | ₹10/crore | ₹10/crore | ₹10/crore |

Stamp Duty | – | – | – | – |

SAS Online Charges For Currency

Currency Futures | Currency Options | |

₹9/trade plan | 0.1% or ₹9/trade

(Whichever is less) | ₹9/trade |

₹999/month plan | ₹0 | ₹0 |

STT | No | No |

Turnover Charges | ₹120/crore | ₹5500/crore (Premium Turnover) |

GST | 18% of (Transaction + Brokerage Charge) | 18% of (Transaction + Brokerage Charge) |

SEBI | ₹10/crore | ₹10/crore |

Stamp Duty | – | – |

SAS Online Charges For Commodity

Commodity Futures | |

₹9/trade plan | 0.1% or ₹9/trade

(Whichever is less) |

₹999/month plan | ₹0 |

CTT | 0.01% (Sell Side) (Non-Agri) |

Turnover Charges | ₹360/crore (Non-Agri) |

GST | 18% of (Transaction + Brokerage Charge) |

SEBI | ₹10/crore |

Stamp Duty | – |

SAS Online Products & Services

The various products & services offered by SAS Online are –

SAS Online Products:

PRODUCTS | |

Equity Trading | Yes |

Commodity Trading | No |

Currency Trading | Yes |

Options | Yes |

Futures | Yes |

Mutual Funds | Yes |

Forex | No |

Banking | No |

SIP | Yes |

Insurance, | Yes |

SAS Online Services Offered:

SERVICES | |

Demat Services | Yes |

Trading Services | Yes |

3 in 1 Account | No |

Intraday Services | Yes |

IPO Services | Yes |

Stock Recommendations | Yes |

Robo Advisory | No |

PMS | Yes |

Trading Institution | No |

Trading Exposure | Up to 2X |

SAS Online Trading Platforms

Trading Platforms | |

Desktop Platform – Windows | Yes |

Desktop Platform – Mac | Yes |

Desktop Browser Platform | Yes |

Mobile Site Platform | Yes |

Android App Platform | Yes |

iOS App Platform | Yes |

Windows App Platform | No |

Other Mobile OS Platforms | No |

Real-time Updates | Yes |

Portfolio Details | Yes |

Online MF Buy | Yes |

News Flash | Yes |

Research Reports | Yes |

Easy Installation | Yes |

Global Indices | Yes |

Stock Tips | Yes |

Personalized Advisory | No |

Interactive Charts | Yes |

Live Markets | Yes |

SMS Alerts | Yes |

Email Alerts | Yes |

Multi-Account Management | No |

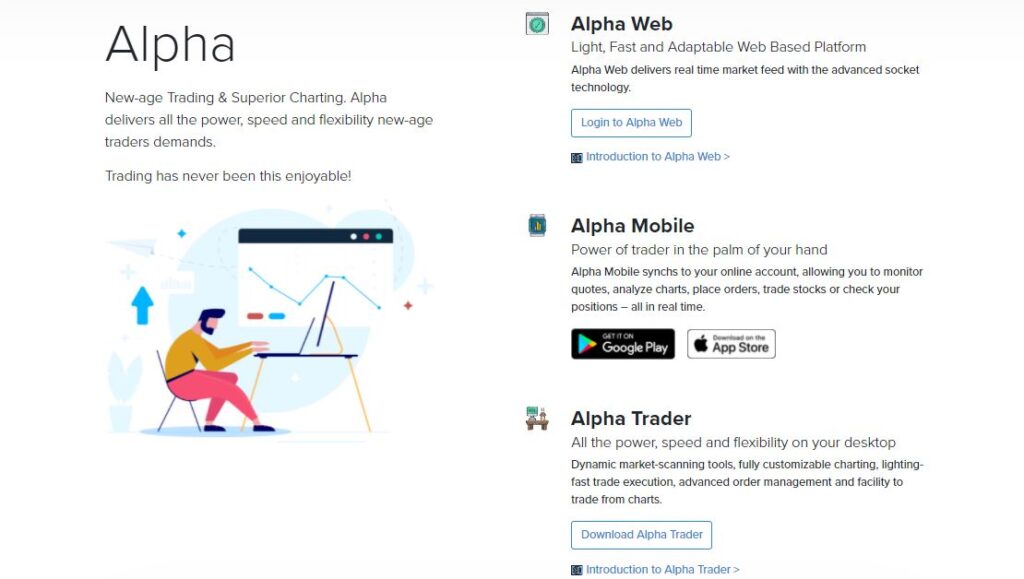

SAS Online Alpha Trader – Trading Terminal

It is an installable terminal designed for the fast execution of orders with real-time monitoring. SAS NEST Trader is a platform offered by SAS Online. It has both desktop and mobile versions that are completely customizable for the user’s needs. The company, in order to make it more accessible, has created an interface that offers easy navigation and allows trades from multiple exchanges without having to log in to each one separately.

SAS Online Alpha Web

It is a web browser-based website. SAS Online also offers a web platform where investors can trade. SAS Online’s client-free trading software enables real-time quotes, which are shown on the screen while making proposed transactions. Margin is constantly monitored and it flashes across the screen as well.

SAS Online Alpha Mobile

It is a smartphone app allowing you to monitor quotes, analyze charts, place orders as well as trade stocks in real-time. SAS Mobile is a mobile platform that has been launched by NEST to provide traders with an easy way of trading. SAS Mobile is mobile-friendly and integrates well with the previous one, which makes it convenient for traders to invest on the go. It also features key security features in order to prevent mishaps or any other kind of problems.

How to Open Demat Account with SAS Online?

Opening an account with SAS Online is a fairly easy process. All you need to do is fill out their forms, and then wait for them to call you.

- The lead forms are required to be filled up online after clicking on the Open Demat Account button below, followed by receiving a phone call from their representative who will share a link with you.

- then upload all of your KYC documents like Aadhar card, Age proof, or other proofs in order to verify that they actually belong on file at SAS Online’s office (as well as provide one photo).

- Finally, get verified more by an official calling you from SAS Online before getting granted access to managing your own Demat account.

Just follow these 3 easy steps to open the Demat account with SAS Online.

Why Open a Trading Account With SAS Online?

The various reasons to open an online trading account are –

- You will be able to access well-established segments of the NSE, MCX, NCDEX, and BSE.

- You’ll get in-depth market research on shares from these exchanges as well.

- Expert sector analysis provides you with reports that you need for your specialized research.

- Your accounts are accessible across mobile devices like smartphones or desktops at any time.

SAS ONLINE CUSTOMER CARE

Customer Support | |

Dedicated Dealer | Yes |

Offline Trading | Yes |

Online Trading | Yes |

24*7 Support | No |

Email Support | Yes |

Chat Support | No |

Toll-Free Number | No |

Branches | Zero |

You get a dedicated dealer when your work with the SAS Online for both Online trading as well as offline trading. You also get email support for the SAS Online Platforms. Customer support is something that always keeps your back. It doesn’t matter if you are a beginner or if you are an expert, the customer support will be your lifeline when you get stuck somewhere. And this is the department where you can bet on Sas Online.

Also, email support is an amazing option for a few people. Because few people are not comfortable talking to customer support directly. And email support is important if you want to raise a complaint while you are busy with the other work.

SAS Online Advantages & Disdvantages

SAS Online Advantages

- You get the margin against the share that you hold in your Demat account. Now, this can be an amazing feature for traders who want a high margin for trading.

- You also get unlimited trading for the BSE (Bombay stock exchange), NSE (National stock exchange), and MCX (Multi commodity exchange) platforms. This means you have to pay the amount one time every month, and then enjoy unlimited trading on these platforms.

- You also get the option of margin funding. This can be really amazing and helpful feature for a few people.

- The trader gets the freedom to trade from any platform they want and they can trade from these platforms without any additional cost. If someone wants location and mobility freedom, they can use the mobile platform. If someone wants the dedicated screen in front of them, they can use the desktop platform.

- There is no such concept as minimum brokerage.

- ALPHA Web trading platform is available for operating systems Mac and Linux. It has re-branded as Omnesys NEST, a trading application that provides its users with high performance.

SAS Online Disadvantages

- SAS Online does not offer features for investing in IPOs, mutual funds, and other types of investments.

- In the Sas online platform, Good Till Cancelled and Good Till Date/Time is not available in the Equity Segment

SAS Online: Final Thought

The new company is designed for all types of traders and investors. It offers services for stocks, futures, and options on the NSE, BSE, and MCX stock exchanges with a user-friendly trading platform that is easy to access from anywhere in the world.