TRADETRON REVIEW

Overview

TradeTron is a cloud-based strategy marketplace that helps you develop and automate your strategies. It also has the capability of backtesting them, as well as selling them to traders all over the world. You can use their automated feature to easily sell these strategies online in order for people all over the world to access them.

While most platforms I have invested in are primarily investment-based, like Klubworks and Finzy; this one is the algorithmic trading platform.

Other online services only provide an opportunity for investing with their trades or providing personal finance advice through articles they publish on their websites.

TradeTron provides automated trading tools to both investors in general and those who wish to build an automated system with specific goals through its online algorithm builder tool which can generate opportunities for beginners without any prior knowledge of programming skills.

TradeTron is a cloud-native trading platform, so there’s no need to install any algo software and there’s no configuration hassle. All you need is an internet connection and a browser for access. As for your strategy conditions, TradeTron checks them out before executing them within seconds with the distributed computing devices in the cloud.

- You can create and backtest your strategy with the trading platform.

- Subscribe to other people’s strategies in their respective marketplaces.

- Fully automate the rules

- Sell your service as a subscription.

Why Do Most Trader Fail?

Tradetron helps you make decisions in the financial markets, both right and wrong. The software we provide is an ecosystem for automated trading strategies that can be replicated to suit your personal needs, with no technical experience required! In fact, we made sure Tradetron was developed to work seamlessly with any broker of choice.

Ecosystem To AlgoTraders

Let’s think about who all contributes to the entire system of algo:

- Strategy Creators

- Investors

- Brokers.

1.Brokers

Tradetron India has a range of brokers- you’re bound to find whatever broker you’re looking for. It’s also built on an open architecture, so it can connect with any broker.

2. Investors

Traders are always in search of new strategies, and Tradetron Marketplace helps you find them. You can subscribe to the strategies and practice trading before going live. This also builds your confidence if you’re uncertain about a strategy.

3. Strategy Creators

The best part of being a tradetron developer is that you don’t need to learn any complicated coding languages. That’s the biggest USP for Tradetrons, and it makes things so much simpler for people like me.

You can actually make orders in options based on technical analysis, like the RSI and Bollinger Bands. You have complete control over billing cycles; you are also skilled at managing your strategy.

Features Of Tradetron

The features of Tradetron algo trading software that make it a great platform are:

Simple Strategy Builder

All you need to do is configure a strategy without writing any code. A mutual fund can be organized into multiple sets, and each set has its own entry/exit conditions. Moreover, the rules of a trade policy can apply to a single stock or an entire basket of stocks (like the Nifty 50).

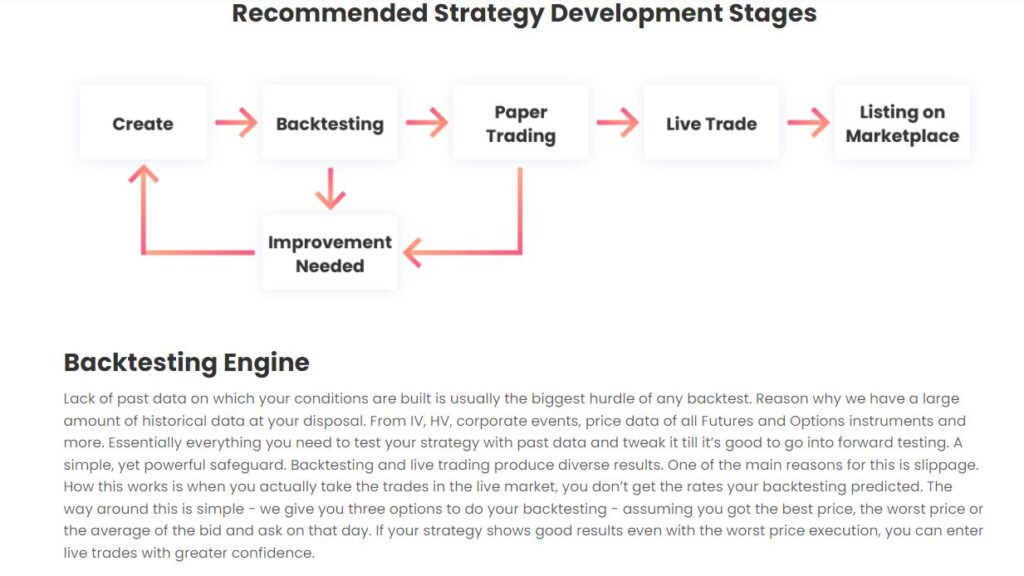

Effortless Backtesting

Configure your strategy conditions in Tradetron, then backtest it by clicking the button from the strategy page itself.

When you get a detailed report of what the strategy was doing on each day of the backtesting period, it can be used to evaluate your strategy.

Copy Top Traders On Tradetron

You can become a top trader just by clicking on subscribe and copying traders – you can then check out their historical performance. You also have the ability to paper trade their tradetron strategies until you are confident enough in what you’re doing.

Tradetron Subscription Fees / Pricing

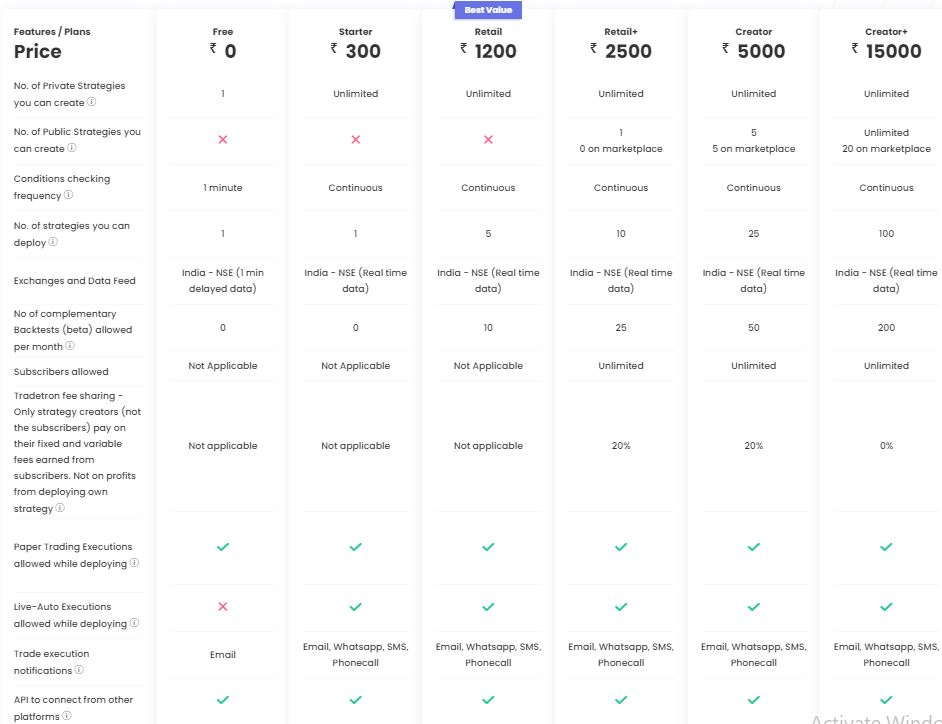

Tradetron is offered at a nominal price for the features it offers. The pricing starts at 1000 INR per month with the retail plan and goes up to 15000 INR per month, with the institutional plan being an option in India’s market. For US markets, they range from $50 to 475 USD per month.

There are free trials as well (0INR) that allow you to do paper trading and create your own strategies – we recommend starting off by using the retail plans as it contains all of what you need in order to fully automate your strategy! If necessary, Retail+ Plan would be a good idea too if your strategy needs continuous condition checks- these are checked every 1 minute instead of 30 minutes like on retail plans).

An 18% GST tax is levied on top of listed prices when the transaction happens over 0INRs but credit card or net banking/UPI payments can happen without any such tax for transactions done under Rs 50k. (For those who want their account set up through credit cards or bank transfers there will be no additional data cost involved other than their subscription fee.)

However, due note: Any marketplace-based algorithmic trading strategies might have some additional fees attached which can be found out while reviewing them.

What Makes Tradetron Different?

- Tradetron is an automated best trading platform that offers a wide range of features. What makes it stand out among all of the others?

- Tradetron is cloud-native, which means no software needs to be installed onto your device.

- Tradetron offers a seamless connection to numerous stock brokers without writing any single line of code.

- At Tradetron, you create a trading strategy and backtest it. You can also automate the execution of your strategy! This is the only platform that offers all three features available to traders.

- With Tradetron, you can subscribe to other strategies through a marketplace in an environment that benefits both strategy creators and subscribers.

- Our platform can trade in US and Indian markets, as well as provide access to multiple instruments, currencies and exchanges. The list is growing every day.

Advantages & Disadvantages Of Tradetron

Advantages of Tradetron

There is no need to write a single line of code on this platform. Please, find out more about how it works!

- Beginner-friendly, there are no prerequisites whatsoever to get started with Tradetron.

- Integrated with all major brokers in India and the United States, we are adding new ones every month. See our supported share broker list here.

- Tradetron is the best execution engine in existence.

- At Tradetron, you can start with as low as 250 INR per month. There is no algorithmic trading platform cheaper than ours! Get the current tradetron pricing details here.

- In case you don’t have the resources to write your own algorithm, you can subscribe to others’ strategies at Tradetron Marketplace.

Disadvantages Of Tradetron

- Backtesting is slow and buggy. It’s better now than it used to be, but it’s still not perfect.

- Stability is not always guaranteed in this game. Even if you try to find the cause of an execution error from logs, it may not be possible for you to pinpoint it – sometimes these errors can happen at random.

- Poor customer support. You’ll get generic canned replies for most of your queries, with the exception of a few cases.

Tradetron Review: Final Thought

The crypto trading algorithm has become a vital component of financial markets and it is the future. No retail trader can avoid adapting to this new way of trading eventually. For long-term profitability, one needs to remove all emotions from their strategy; TradeTron provides insight into how that works by providing everything you need for algorithmic trading in one place. The company’s patent-pending tradetron technology requires little learning curve but before launching any strategy or copying a top trader from our marketplace, we advise traders first backtest and paper trade your idea with TradeTron’s tools.