5 Paisa Review

Overview

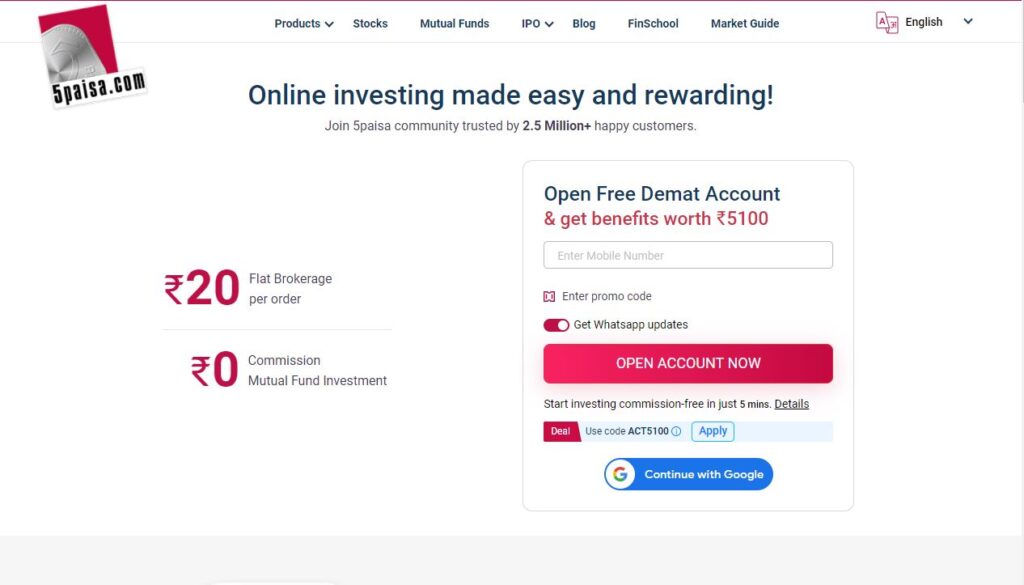

5paisa Capital Limited is an online discount broker based in Mumbai. The company started its discount broking operations in 2016 and became the 2nd largest online broker in India by late 2018. It offers stockbroking, and investment services to customers, as well as trading stocks, commodities and derivatives. Besides this it also provides other financial products like mutual funds or insurance loans for you – just ask! 5paisa Capital Ltd is a Depository Participant of NSDL

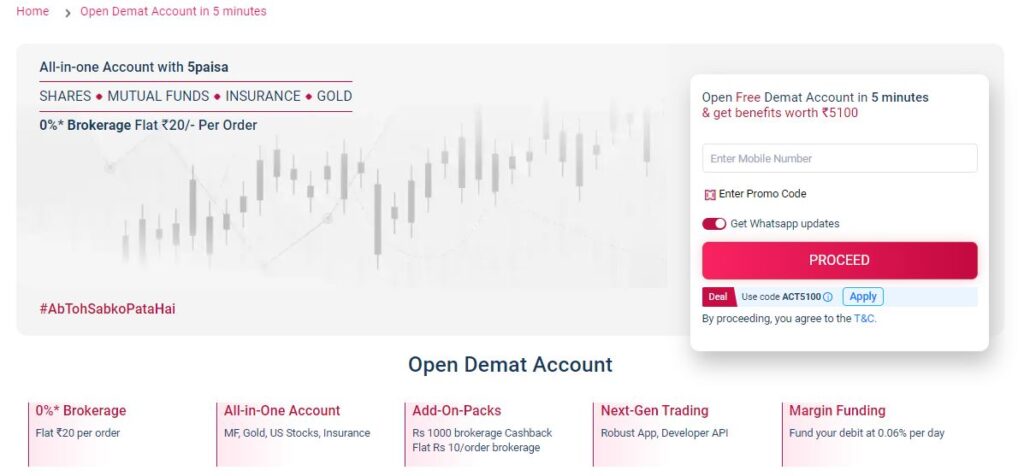

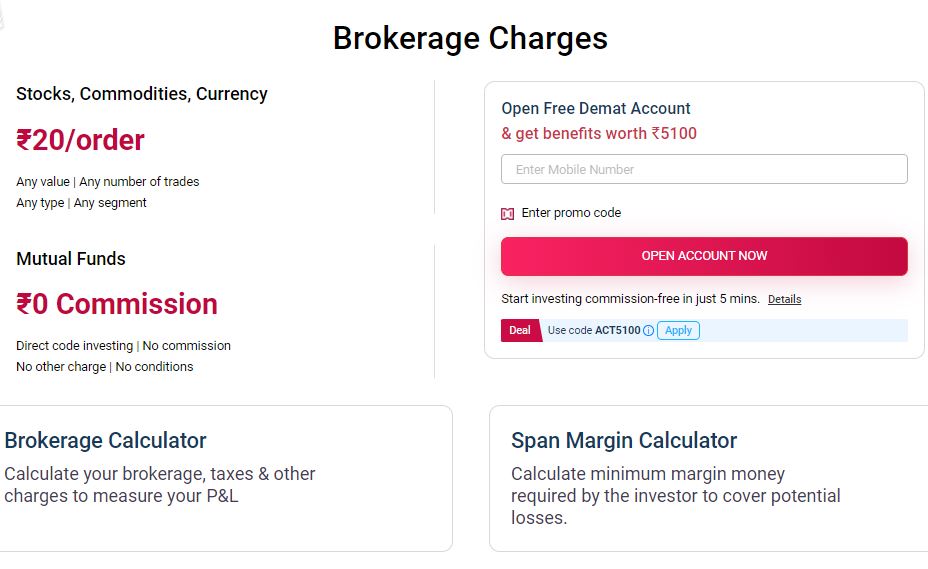

5paisa.com’s USP (Unique selling price) is its low brokerage fee, which charges a flat fee of Rs 20 per executed order irrespective of size. The in-house built trading platform offered to all customers for free is another great selling point for 5paisa.com.

5paisa.com is a leading online broker in India that offers discount brokerage firms services for retail investors too. 5paisa Capital Ltd is a well-managed company, with over 1.2 million clients and was promoted by the founders of IIFL.

5paisa is a discount brokerage that charges a flat ₹ 20 per trade regardless of the size, type or exchange. 5paisa online trading is available in equity, commodity and currency at BSE (Bombay Stock Exchange), NSE (National Stock Exchange) and MCX.

They offer a completely paperless trading and 5paisa Demat account opening service.

The company has 1.2 million customers and a daily turnover of Rs 50,000 crore.

The company has a lot of positive statistics: 6.5 million app downloads, assets worth 3000Cr+, 170% growth in the last fiscal year (FY 2020-21), and multiple prestigious awards under its belt.

The company offers a one-of-a-kind service through its multi-product 5paisa app, and it provides research on more than 4,000 companies.

About 5 Paisa | |

Company Type | Public |

Headquarters | Mumbai |

CEO | Prakash Gagdani |

Broker Type | Discount broker |

Established Year | 2016 |

The company has 1.2 million customers and a daily turnover of Rs 50,000 crore.

The company has a lot of positive statistics: 6.5 million app downloads, assets worth 3000Cr+, 170% growth in the last fiscal year (FY 2020-21), and multiple prestigious awards under its belt.

The company offers a one-of-a-kind service through its multi-product 5paisa app, and it provides research on more than 4,000 companies.

How 5 Paisa Is Different From Other Online Brokers?

At 5paisa, we offer a range of investment products and services that are tailored to your needs. Below are the reasons why you should choose us for all of your financial requirements.

Lowest Charges – 5 Paisa charges Rs 20 for each order executed is among the cheapest in the market. This becomes even more affordable with our value add packs, which are undoubtedly the lowest in the industry.

Research Ideas – 5paisa is a discount broker that provides extensive research and advisory on more than 4,000 companies. It offers short-term and long-term calls, Derivative strategies, as well as portfolio-based investment ideas.

Margin Funding – 5Paisa provides the customer with a facility of margin trade funding which means that they only need to pay a partial amount of their delivery bought in the cash segment. The balance is funded by 5paisa for an interest rate of 0.06% per day at no cost.

Multi-Product App: 5paisa is not just a trading app – it provides an all-inclusive platform that offers you access to different investment products, including gold, peer-to-peer lending, insurance policies, and mutual funds.

Analytics Service – 5paisa offers Portfolio Analyzer – a tool to analyze the performance of your portfolio and improve its strategy.

Account Type

1. 5 Paisa Trading & Demat Account

5paisa is a discount broker that offers services in various segments including stocks, derivatives, and currency. 5paisa is a member of the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Its trading account comes backed by experience and technology developed over 20 years by its parent company IIFL retail broking industry. Trading at 5Paisa offers customers an excellent chance to save up to 90% when compared with traditional brokers who charge brokerage fees on total turnover ratios for each trade.

5Paisa Trading Account is well-integrated with other products they offer, including mutual funds, stocks, and bonds, as well as insurance.

2. Mutual Fund Account

With 5paisa, you can open an online Mutual Funds Investment Account for free. The different types of plans that are available on our website include Systematic Investment Plans (SIP), which is a periodic investment option in the stock market through mutual funds. Additionally,

we have ‘Auto Investor’, a tool that’s completely free to use and helps with advising on MFs according to your risk profile and return expectations. This tool is available at no cost to all our customers.

5 Paisa Account Opening Charges

Services | Charges |

Trading annual maintenance charges (AMC) | ₹ 0 |

Trading 5paisa account opening charges (One time) | ₹ 300 |

Demat account maintenance charges (AMC) | ₹ 540 charged as Rs 45 per traded month |

Demat account opening charges (One time) | ₹ 0 |

5 paisa’s 2-in-1 account (Demat and trading) gives its customers an option to invest or trade in the stock market, as well as in mutual funds. If you are interested only in a Mutual Fund Account for investments, it is also available.

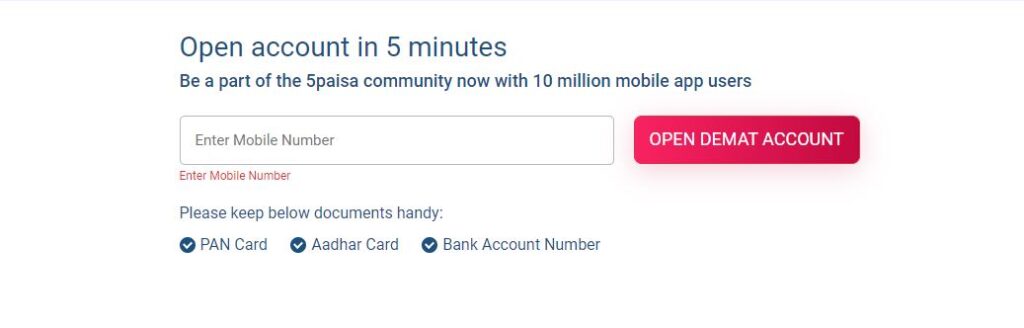

Five paisa offers account opening with an Aadhaar number. With just your phone number and an Aadhaar, you can open a faster paperless account! You don’t have to fill out the application or wait in line; it only takes a few hours for an online trading account to be activated.

You can also download the application form, print it, fill in your details and send it to the 5paisa Mumbai office so they can open an account for you.

5 Paisa Subscription Plans

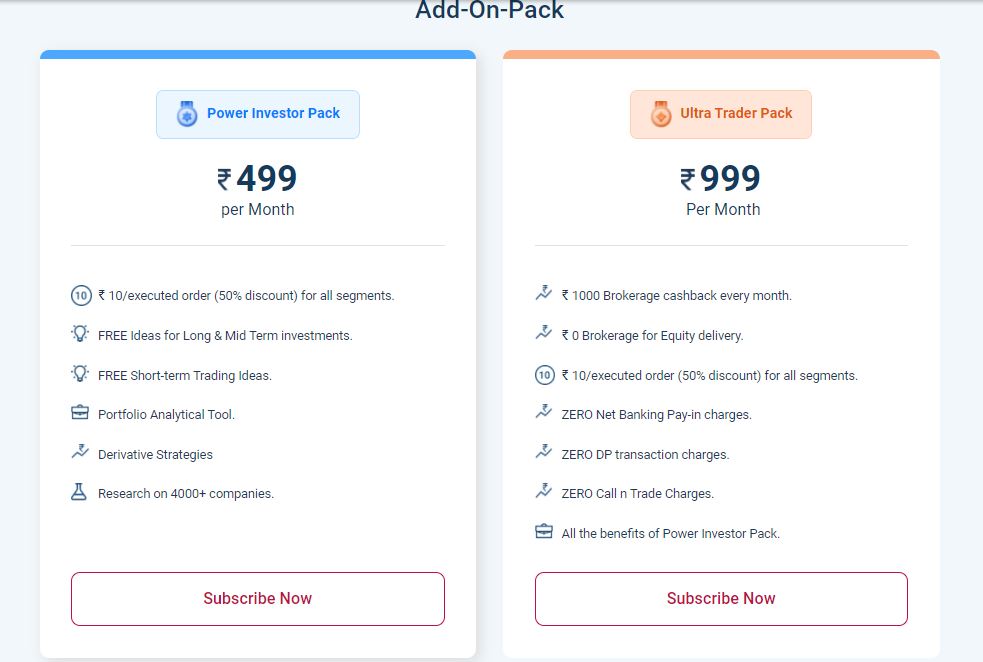

With a range of three plans, 5Paisa offers you the option to subscribe and enjoy your favourite plan. New customers can sign up for our Basic or Power Investor Plans while opening an account with us. Existing customers can use our website or mobile application to subscribe to any of the three plans we offer – UltraTrader, Power Investor Plan, and Basic Plan.

5 Paisa Best Brokerage Charges

Segments | Investors Plan | Premium Plan | Super Trader Plan |

Monthly fee (Fixed) | NA | ₹ 499 per month | ₹ 999 per month |

Equity Intraday | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 10 per executed order |

Equity Delivery | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 0 (Free) |

Equity Options | ₹ 20 per executed order | ₹ 2 per lot | ₹ 2 per executed lot |

Equity Futures | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 10 per executed order |

Commodity Options | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 10 per executed order |

Currency Futures | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 10 per executed order |

Commodity futures | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 10 per executed order |

Currency options | ₹ 20 per executed order | ₹ 10 per executed order | ₹ 10 per executed order |

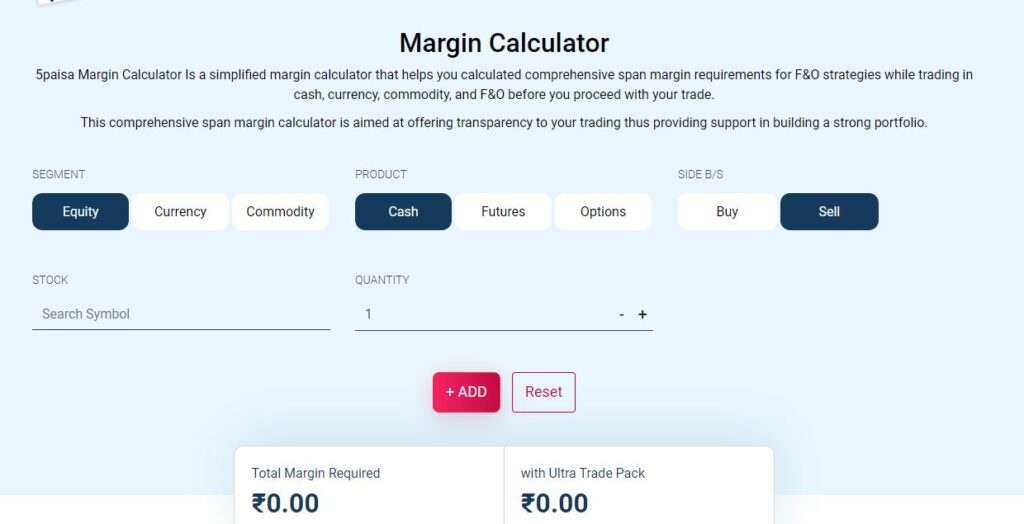

5 Paisa Margin Exposure

The best brokerage company provides a maximum of 5x exposure to their clients, but it can vary over time depending on various parameters.

- Client Holding – Clients are given high exposure by Trader or other premium clients

- Clients with History – Old clients get high leverage.

- Type of investment – Currency, Commodities, Derivatives, Equity

- Scrip is a type of stock which only has high net worth companies.

Add on pack | Basic Pack | Power investor pack | Ultra trader pack |

Equity intraday margin | 5x | 5x | 5x |

Equity delivery margin | 1x as per exchange | 1x as per exchange | 1x as per exchange |

Equity options writing margin – sell | 1x | 1x | 1x |

Currency options writing margin-sell | 1x sell only | 1x sell only | 1x sell only |

Currency future margin | 1x both | 1x both | 1x both |

Equity future margin | 1x | 1x | 1x |

Commodity option margin | NIL | NIL | NIL |

Commodity futures margin current & near month | NIL | NIL | NIL |

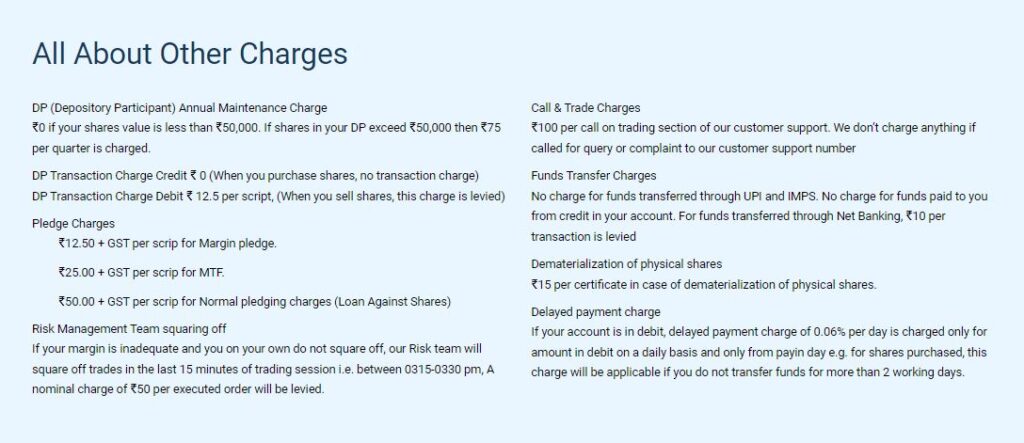

5 Paisa Other Charges

Segments | Other Charges |

SEBI turnover charges | 0.00005% (₹ 5/crore) |

Stamp Duty | (On buy-side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options:0,003% and Currency F&O -0,0001%. Commodity Futures:-0,002% and Commodity options-0.003% (MCX). |

STT | Equity Delivery: 0.1% on both buy & sell Trading equity intraday: 0.025% on the sell-side Equity Futures: 0.01% on the Sell-Side Equity Options: 0.05% on the Sell-Side (on Premium) Commodity Futures: 0.01% on the sell-side (Non-Agri) Commodities Options: 0.05% on the sell-side Currency F&O: There are no transaction costs (No STT) On Exercise, transaction fee: 0.125%. The right to entitlement is 0.05% on the sell-side |

Margin funding charges | 18% + GST |

GST | 18% on (Brokerage Fee + Transaction Charge + SEBI Fee) |

Account closure charges | ₹ 25 per instruction |

Reactivation charges | ₹ 20 per instruction |

Share transfer from your Demat account, unpaid securities account, margin funding account or margin trading a/c to the seller’s bank a/c upon sale of shares. | Flat ₹ 12.5/- DP charges |

Transfer of shares from your Demat account to another, as requested by you. | Flat ₹ 12.5/- DP charges |

Dematerialization charges | ₹ 30 per instruction |

Apart from brokerage charges, other small fees are also levied on the client, but they account for a very low percentage of all costs.

These charges are minimal and do not affect the overall ROI of the investment.

5 Paisa Products & Services

Here are the products and services provided by this company.

PRODUCTS | |

Equity trading | Yes |

Currency trading | Yes |

Commodity trading | Yes |

Futures | Yes |

Options | Yes |

Forex | No |

Mutual funds | Yes |

Insurance | Yes |

Banking | No |

SIP | Yes |

5 Paisa Other Products & Softwares

- The Portfolio Analyser is an advanced tool that allows users to track, analyze and weigh their decisions.

- Swing traders can take advantage of the short-term investment ideas provided by 5Paisa. The stock broker uses all kinds of swing trading strategies to get them started.

- Smart Investor – The experts handpick stocks and present them via the Smart Investing Tool for above-average returns.

- Smallcase is a modern investment tool for first-time investors. It features low-cost and long-term investments that help you invest in multiple stocks without affecting the risk of your portfolio.

- Sensibull is a tool that can help traders in the options market. It offers features like tracking your positions and scenario analysis of your trades using graphs.

5 PAISA SERVICES

SERVICES | |

Demat Services | Yes |

All in 1 account | Yes |

Trading services | Yes |

IPO services | Yes |

Intraday services | Yes |

Robo advisory | Yes |

Stock recommendation | Yes |

Trading exposure | Upto 5x |

PMS | No |

Trading institution | No |

Other Services

- With its omnichannel support, the 5paisa has integrated all of its services and stays on top of new technology.

- As a portfolio analytics tool, 5paisa helps its customers to increase the profitability of their portfolios.

- Wealth portfolio advisory services are a new avenue introduced by 5paisa to meet the needs of its customers. This has been initiated to ensure long-term investments for investors in order for them to enjoy a steady income.

- The 5paisa platform provides different language options for customers – considering the regional diversity of our country, it offers not just English but other distinct languages.

5 Paisa Trading Software

5paisa provides the customer with trading software that is easy to use. Customers can choose between web, mobile, and desktop apps to trade based on their convenience.

5 Paisa Mobile App (Mobile trading app)

With the 5paisa mobile trading app, you can trade online using your smartphone across a variety of segments and exchanges. The majority of all trading done with 5paisa is done through its mobile app.

The 5paisa trading mobile app is available for Apple and Android phones. It offers a variety of features to analyze and trade on the go, including

- With a simple design and an intuitive interface, this app is perfect for mobile devices.

- Trade and invest in stocks, commodities, currencies, mutual funds and more.

- You can access research and advisory inside the app.

- Live quotes on the stock and markets.

- In advance order types, place bracket orders (BO) and cover orders (CO).

- Ordering is just one click away.

- Access to ‘Auto Investor’, a tool that recommends mutual funds based on your profile and goals.

- Multiple watchlists.

- Get an instant personal loan that is paperless.

- Members have access to the 5 paisa forum.

- Track your trades and investments whenever you want.

- Money transfer via UPI.

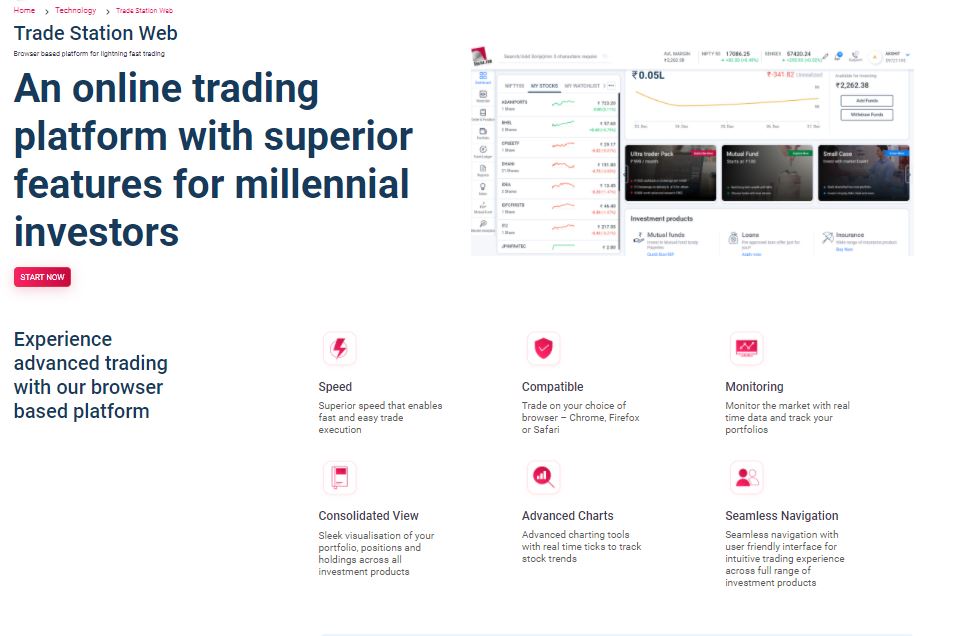

Trade Station Web (Browser-based platform)

5paisa.com (Trade Station Web) is an online trading website of 5paisa broker, which is compatible with Chrome, Firefox and Safari browsers. You can use your personal computer to access the website and trade in a range of features such as:

- Access to the NSE and BSE, as well as trade-in stocks, derivatives and currencies.

- A comprehensive portfolio tracker.

- Monitor your market watchlist to keep an eye on the scrips.

- Detailed script data including market depth and the Option Chain.

- With advanced charting tools, you can see a detailed scrip view.

- Detailed script data including the market depth and Option Chain

- Slice your order to get a better price.

- Bracket Orders (BO) and Cover Orders (CO).

- This consolidated view will show your positions and holdings across instruments.

- There is a fund transfer facility.

- You can access and generate multiple reports.

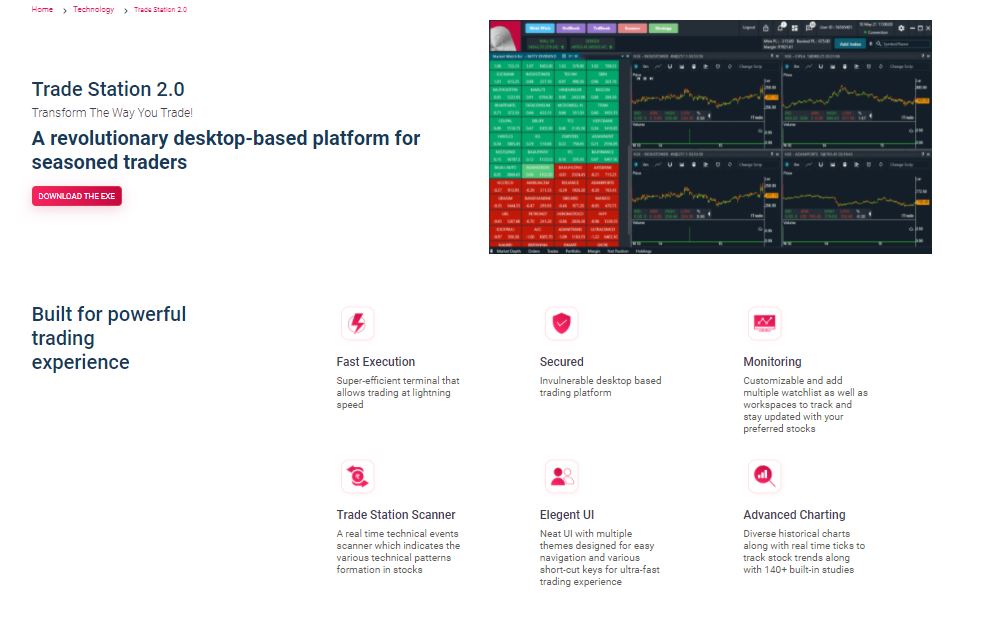

Trade Station EXE (Desktop Trading Platform)

Trade Station EXE is a downloadable trading software with many features. It can be downloaded on your desktop or laptop and it provides access to online trading. The software offers a range of applications including-

- A high-speed desktop trading platform with access to the NSE and BSE

- You can set up customizable watchlists – for example, to monitor your favourite stocks and contracts.

- You can use advanced charting features to analyze stocks.

- Bracket Orders & Cover Orders

- Instant fund transfer

- Order Slicing allows you to access better prices.

- Shortcut keys can be used to trade faster.

5 Paisa Algo Trading (Automated Trading Tool)

5paisa Algo trading is an automated trading tool that utilizes advanced technologies to facilitate automatic trade decisions. It has a range of features including-

- You can create, backtest, and deploy your algorithms.

- With preloaded algorithms, you can try Amibroker, Jobbing, Pivot, buy/sell call execution; bulk buy/sell and paired spread trading strategies.

- Expert assistance for coding strategies.

- To code your own strategies, you will need to get API documentation.

- Seamless integration of strategies into the trading platform.

- As part of the approval process, assistance in getting the strategy approved by the exchange.

- Testing your strategy in a realistic environment can be useful.

5 Paisa Robo Advisory (Mutual fund Selector)

5paisa Robo advisory is a fully automated financial advisor that provides you with suggestions for mutual funds based on your income, goals, and time frame.

How Does Robo Advisory Works?

5paisa Robo advisor is a fully automated tool that recommends an investment plan to you, based on the answers you provide to various questions.

Steps in 5 Paisa Robo Advisory

- Select your financial goal – buying a car, paying for your child’s education or retirement.

- Set a quantitative target of the exact amount required to meet your financial goals and the time frame in which you want to achieve them.

- Enter monthly income, your age & savings

- Select your level of experience and knowledge about the investment market

- Select the risk level.

- Select what type of investment you’re looking for, based on risk and return.

- Analysis of your risk profile

- The system recommends a list of mutual funds.

5 Paisa Advantages & Disadvantages

Advantages of 5 Paisa

The following are the advantages of 5paisa. Read about the pros and cons before opening an account with this company so you can make a decision if it is right for you.

- Flat 20 Rs for every order, irrespective of size and segment or exchange.

- With a single account, you can invest in stocks, mutual funds, commodities, currencies and research.

- You can open a free, paperless account in five minutes.

- Get a free mutual fund account.

- Lowest DP Charges

- A multilingual trading app

- Free best trading platform including a mobile app, website and desktop trading terminal. No software charges

- Provide tools that allow investors to research and analyze stocks.

- For an additional cost, they offer free technical research and advice to customers.

- Technical support is available both through email and mobile.

- Algorithm trading and Robo advisory services

Disadvantages of 5 Paisa

These are the disadvantages of 5paisa.

- This service doesn’t provide a 3-in-1 account.

- Higher transaction charges for exchange rates in comparison to other discount brokerages.

- The charges are very high. They charge Rs 25 or 0.025% in the Optimum plan.

- Optimum Plan does not offer research and advisory services.

- Call & Trade is available for customers in the Optimum plan at an additional cost of ₹ 100 per call. Customers can place any number of trades in one call for just ₹ 100.

- 5Paisa does not offer NRI Trading.

5 Piasa Review: Final Thought

If you are looking for a discount broker, 5paisa is the best one to go with. It has decent client ratings and it can be found at 8.38 out of 10 if we rank them using the same rating scale that our critical experience in stockbroking suggests they use.

They do not have an offline presence and their advisory service is completely dependent on machine learning, which can cause a significant error for new investors.